Image source: Getty Images

Still not sure what accounts payable and accounts receivable are? Stay with us as we explain why each is important and when to use them.

If you’ve only recently stepped foot into the accounting and bookkeeping arena, you may still find yourself confused about accounts payable and accounts receivable. Both processes are part of the accounting cycle and are regularly used by businesses that use double-entry or accrual accounting.

While accounts payable and accounts receivable are managed in a similar way, there are some major differences between the two, with the single biggest difference being that accounts payable is a liability account, while accounts receivable is an asset account.

If you recall, assets are anything your business owns, while liabilities are anything your business owes.

Remembering this distinction will make it much easier to manage accounts payable and accounts receivable for your business, though making the choice to use small business accounting software will make the process easier still.

Overview: What are accounts payable?

Accounts payable is what your business owes vendors for any items that are purchased on credit. Examples of accounts payable include:

- Electric bills

- Rent

- Postage

It’s up to your vendors to determine if they’re willing to extend credit terms to your business. If they do, any invoice you receive will likely have a very specific pay-by date that you’ll need to abide by in order not to violate the credit terms extended.

For instance, your business has 25 booklets printed to distribute to potential customers. The store has agreed to sell you these items on credit, with the bill due within 30 days of the invoice date.

You receive the items the next day, along with a bill in the amount of $313. The journal entry to record the bill into accounts payable would be:

|

Date |

Account |

Debit |

Credit |

|---|---|---|---|

|

6-30-2020 |

Printing Expense |

$313 |

|

|

6-30-2020 |

Accounts Payable |

$313 |

Journal entry to add the office supplies bill to your accounts payable account.

Recording accounts payable will increase your accounts payable liabilities by the amount of the invoice or expense. When it’s time to pay the bill, you would debit accounts payable and credit your cash account to indicate that the bill has been paid, thus reducing your liability account.

The accounts payable process is much easier if you’re using accounting software, as most accounting software applications handle vendor management, proper expense allocation, and the ability to track due dates to ensure payments are made on time.

But accounts payable isn’t just about paying bills. Managing accounts payable properly for your business helps you build valuable professional relationships with vendors and suppliers and ensures that you pay your bills promptly, eliminating costly late fees in the process.

How to record accounts payable

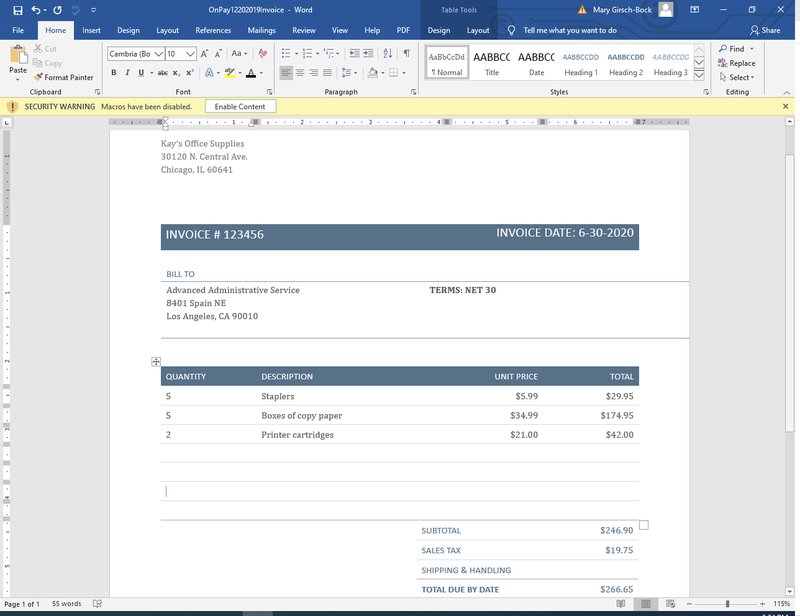

Advanced Administrative Services receives the following invoice for office supplies it purchased from Kay’s Office Supplies. Because Advanced Administrative Services is able to purchase items on credit, when this invoice is received, it’s recorded as an accounts payable item.

Because the invoice has accounts payable terms of net 30, and the invoice date is 6-30-2020, you will need to pay the $266.65 by July 29.

An example of an invoice with net 30 terms. Image source: Author

|

Date |

Account |

Debit |

Credit |

|---|---|---|---|

|

6-30-2020 |

Office Supplies |

$246.90 |

|

|

6-30-2020 |

Sales Tax Expense |

$ 19.75 |

|

|

6-30-2020 |

Accounts Payable |

$266.65 |

When the invoice is paid, the journal entry would be:

|

Date |

Account |

Debit |

Credit |

|---|---|---|---|

|

7-20-2020 |

Accounts Payable |

$266.65 |

|

|

7-20-2020 |

Cash |

$266.65 |

This above entry decreases your accounts payable balance by the amount of the bill, while also decreasing your bank account balance.

What is accounts receivable?

Any time you sell goods or services to your customers, you’re increasing your accounts receivable balance. Accounts receivable represents the money owed to you by your customers who have been extended credit terms.

Properly managing your accounts receivable balance is vital for any business, particularly small businesses with limited cash flow. Proper accounts receivable management actually starts at the initial decision to provide your customers with credit, and ends with implementing proper collection activities for customers that do not pay on time.

One of the easiest ways to determine how quickly your customers are paying you is to calculate your accounts receivable turnover ratio, which tells you how efficiently your entire accounts receivable process is functioning.

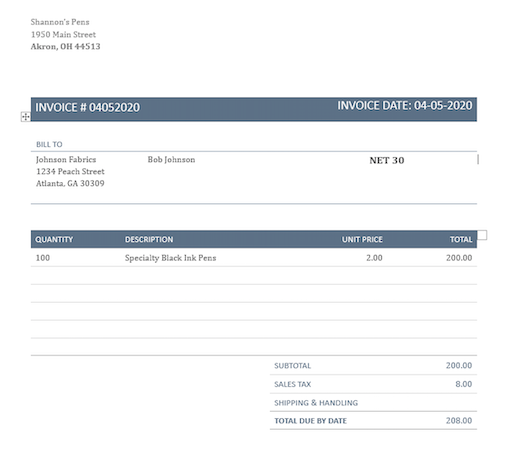

For example, Shannon’s Pens sells specialty pens to Johnson Fabrics with credit terms of net 30. This means Johnson Fabrics has until May 4 to pay the invoice and still be in compliance with the terms.

If Johnson Fabrics don’t pay by then, Shannon’s Pens will need to follow up and possibly start the collection process, with an option to also add a late fee to the past-due balance.

This is an example of an invoice issued by Shannon’s Pens. Image source: Author

How to record accounts receivable

The journal entry to record accounts receivable is simple, though you’ll need to remember to separate out your sales tax, since that will need to be remitted to the correct authority whether your invoice is paid by your customer or not.

The entry to record the invoice sent to Johnson Fabrics is:

|

Date |

Account |

Debit |

Credit |

|---|---|---|---|

|

4-05-2020 |

Accounts Receivable |

$208 |

|

|

4-05-2020 |

Sales |

$200 |

|

|

4-05-2020 |

Sales Tax Payable |

$ 8 |

Remember, because accounts receivable is an asset account, we’ll need to debit it. Once the invoice has been paid, you’ll then debit (increase) your cash account while crediting accounts receivable, which has decreased.

|

Date |

Account |

Debit |

Credit |

|---|---|---|---|

|

5-03-2020 |

Cash |

$208 |

|

|

5-03-2020 |

Accounts Receivable |

$208 |

Accounts payable vs. accounts receivable: What’s the difference?

Accounts payable and accounts receivable play important roles in the accounting cycle. Both accounts payable and accounts receivable are reflected on your balance sheet, with their respective balances directly affecting cash flow and net income.

Accounts payable is a current liability that represents money you owe your vendors and suppliers. Whenever you receive a bill from a vendor or supplier, it should be recorded into accounts payable and paid by the specified due date.

Accounts receivable is a current asset and represents money owed to you by your customers for goods and services sold to them on credit. Anytime you sell products or services to your customers on credit, it should be recorded in accounts receivable.

Accounts payable and accounts receivable are equally important

If you’re using accrual accounting, both accounts payable and accounts receivable have a direct impact on your business, and they’re equally important. Both are needed in order to create accurate financial projections, calculate current cash flow, and even alter or change management processes.

The inability to obtain business credit, a drop in your creditworthiness, a long list of uncollectible invoices, or a significant drop in cash flow can all be the result of mismanaging these two very important accounting tasks.

More Stories

Quick Guide to Implementing Business Intelligence, Data Warehousing & BPM

How to Start a Foreclosure Cleanup Business “On the Cheap”

The Top 10 Keys to Building a Successful Business