Impression supply: Getty Illustrations or photos

House management accounting is no a lot more difficult than any other accounting. The Ascent guides you through a system to account for rents and related fees.

Residence administration is annoying. Previously this yr, we experienced an earthquake here in Utah. I speedily checked my h2o heater and furnace to make sure we didn’t have any gasoline leaking. Next I had to make positive our rental homes had been Alright.

One tenant texted appropriate absent and reported that he experienced checked almost everything and it was all excellent. That was a relief. The other tenant reported he was out of city and couldn’t check, so I remaining perform to operate to the apartment and make confident it wasn’t about to explode. Turns out it was quite shut.

When I obtained there, I found out the furnace had arrive wholly off the wall. I promptly turned off the gas and called the fuel enterprise. Quite a few hundred pounds, an irritated tenant who came household early to a 50-diploma condominium, and a couple of times of high blood pressure later on, the furnace was fastened. I was moderately absolutely sure the condominium would not explode anytime shortly. But was that cigarette smoke I smelled in the dwelling place?

Accounting for your rental houses doesn’t have to be this nerve-racking. Study on to find out how to set up a technique for your house management accounting.

Overview: What is property administration accounting?

Assets administration accounting is landlord accounting. You understand revenue for all rents received and charges for servicing, landscaping, and other dollars outflows.

How to set up a home administration accounting system

Listed here are the actions I’ve personally used for a few diverse scenarios I have been concerned in.

1. Determine your tipping stage

I do property administration bookkeeping in two distinct ways. I personally have two condos that are rented to tenants I obtain on a neighborhood classifieds web-site. In my working day position, I handle 20-30 units owned by the entrepreneurs of my company.

For the two condos, I retain a monetary assertion spreadsheet current annually for when I’m executing my taxes. Each individual month, I examine to make absolutely sure the hire payment went by, and I retain receipts for the 12 months in a physical folder. I only do an revenue statement. Trying to keep a stability sheet current would be additional get the job done than it is value for these little models.

For rental residence accounting in my experienced potential, I use our accounting software package to do month-to-month lender reconciliations and keep the rent roll up to date (we’ll get to these phrases in a moment).

There’s no rule for when you need to graduate from back-of-the-envelope bookkeeping to a whole method with double-entry accounting. If you only have a number of transactions per yr, you can in all probability adhere to a spreadsheet. If you’re processing multiple invoices every month, you probably need to purchase accounting software package.

2. Invest in accounting software package

You will not will need to discover precise application for landlords. Verify out our accounting software opinions and go with the one particular you like the most — it will perform for home management.

Accounting for property management is done finest when it’s like each other business enterprise. So ordinary accounting program will have all the features that you have to have.

3. Established up every single assets

Each property will need to have various objects established up for it:

- Entity: If you have a professional assets with several units, place it into its possess LLC to shield yourself from liability.

- Software account: Your accounting software really should permit for numerous businesses to be made. Make a individual one particular for each individual entity.

- Financial institution account/credit score card: The least complicated way to continue to keep monitor of expenditures for every house is to use a financial institution account or credit rating card for that residence only. Then each and every thirty day period you go via the assertion and insert just about every journal entry into the software program.

- GL and chart of accounts: Established up a typical ledger and chart of accounts for each individual rental assets. The far better you establish them to begin with, the less difficult it will be to swiftly approach transactions every month.

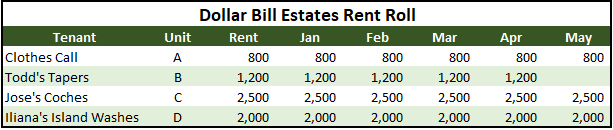

- Hire roll: Produce a spreadsheet with just one row for each and every device. Every month when lease is paid out, incorporate the payment in. The graphic below shows how the hire roll must glance.

This hire roll demonstrates that Todd’s Tapers is late on their Might payment. Impression supply: Writer

4. Do the month to month accounting cycle

Below are the techniques you need to consider for every single month’s accounting cycle.

- Receive rents: Many accounting software package systems will integrate with your lender account and make it simpler to established up automatic regular invoices with ACH (Automatic Clearing House) payments. If your computer software doesn’t do this, meet with your bank’s treasury management consultant to established up month-to-month ACH pulls from your tenants. Alternatively, you could require your tenants to set up computerized invoice fork out or an ACH thrust to your account. The critical is taking the month-to-month lease responsibility out of your tenant’s fingers and creating it an computerized payment.

- Approach invoices: You are going to get invoices for utilities, landscaping, upkeep, and other random fees each and every thirty day period. Lots of of these can be quickly paid out with electronic cash transfers. Use your accounting software program to print checks for the other ones.

- Do lender reconciliation: Historically, a lender reconciliation is performed to make sure the harmony sheet income amount matches the financial institution stability. We nevertheless want to do that, but we’re heading to do it a little backward. Enter all transactions from the bank statement into the application (unless the transaction is from a test that you by now entered). When which is carried out, compare the guide (the software volume) stability of money to the assertion balance. If it’s not the identical, go back again by means of the assertion and your GL to determine out what was incorrectly entered.

- Print financials: You can do this every thirty day period, quarter, or year. For greater qualities, it may perhaps make sense to do it regular monthly to make sure you are not burning a ton of hard cash. As extensive as you built the GL accurately and entered all transactions into the suitable account, your property administration economic statements will just have to have to be printed.

This is the cycle I comply with for the properties in my qualified everyday living. We print financials yearly for taxes and continue to keep up with the financial institution equilibrium throughout the calendar year to make sure there is not a hard cash burn.

With the two condos that I personally have, I use a web-site termed Cozy to do month to month lease payments and have a credit rating card that I only use for the expense homes. I frequently have four or five non-HOA (homeowner’s affiliation) expenditures every year, so it’s effortless plenty of to throw it all with each other on a spreadsheet at the conclude of the 12 months.

Guidelines and tricks for environment up a prosperous accounting program for property administration

Owning an accounting process in position for controlling your houses will aid you ensure you really don’t overlook any due dates and — preferably — it will help you save you a great deal of time.

1. Link accounts

If you can url your accounting software to the financial institution account for just about every entity, it will make the month to month cycle at least 240% less complicated. Rather of laboring to enter in every line of the statement, you can just confirm that the imported transactions are applied to the suitable accounts.

2. Do once-a-year appraisals

There is always an chance charge to carrying expenditure houses. Make a apply of receiving a Broker’s Price Viewpoint (BPO), or even do your personal valuation on the qualities annually, to determine irrespective of whether you want to keep them or try to market.

3. Assess the financials at least yearly

There are 4 approaches that you make dollars on financial commitment attributes:

- Capital appreciation: When the worth of the house goes up, and you can market it for extra.

- Rental dollars stream: The actual income that finishes up in your pocket at the conclude of the calendar year.

- Tax shelter: Tax deductions from products such as depreciation (non-funds) or curiosity.

- Financial debt paydown: Ideally, you will order a house for the the very least sum down feasible and then cost far more in lease than is thanks on the financial debt. When this is effective out, you are correctly having a tenant fork out down the mortgage loan and obtaining the asset for absolutely free. The greatest of the two worlds is when the tenant conveniently clears the credit card debt payment, but curiosity and depreciation make the residence show a reduction on your tax return.

When you operate your once-a-year financials, perform on making ready a income move assertion. The income circulation assertion and appraisal will allow you quality every residence on individuals four important metrics every single year.

4. Understand lease kinds

Most professional leases are so-referred to as triple web (NNN) leases. This implies the tenants are liable for paying out their share of all prevalent area costs this sort of as landscaping or snow elimination. If you have NNN leases, you want to keep up on prevalent location expenses and monthly bill tenants yearly.

5. Don’t forget about the hire roll

If you want to get a personal loan on the assets or market it, the initially issue you will be questioned for is a hire roll. Obtaining one particular accurate and up to day will go a long way towards building interacting with 3rd parties easier — not to mention encouraging you recognize delinquent tenants faster.

(Land)lord of the Flies

If you have used time in property administration, you’ve probably had the identical tense times (or weeks) that I have experienced. However, accounting for your properties doesn’t have to be an earthquake-stage trauma.