hapabapa/iStock Editorial by way of Getty Illustrations or photos

Financial investment thesis

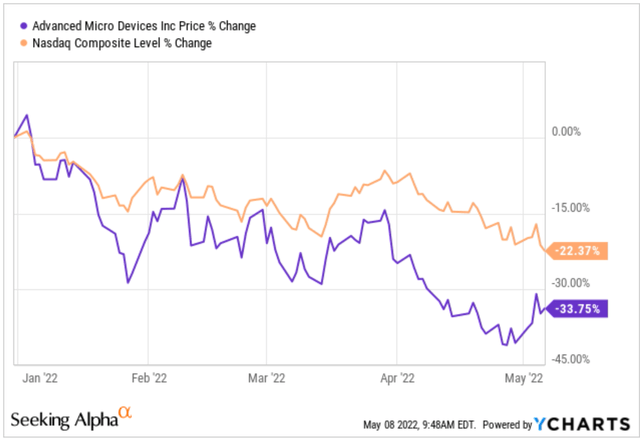

The NASDAQ composite index has dropped far more than 22% YTD. And this kind of substantial marketplace corrections have developed several opportunities to acquire significant-expansion shares at an beautiful valuation.

Sophisticated Micro Gadgets (NASDAQ:AMD) is a large-progress enterprise that is now priced as a benefit investment decision. AMD rates have dropped 33% YTD. At the present-day valuation, all its adverse situations have been completely priced in. On top of that, AMD’s correct economic or owners’ earnings have been consistently much better than its accounting earnings. You will see that its valuation is even additional eye-catching than on the surface area, by about 30% based mostly on a Greenwald evaluation to alter for the advancement CAPEX.

Optimistic situations, on the other hand, have been downplayed or even overlooked. Critical in the vicinity of-time period catalysts incorporate the Xilinx synergies and even more margin expansions. Xilinx not only furnished speedy money rewards (introducing $559 million in income in the six months next the acquisition) but also enormous lengthy-phrase opportunities to grow its addressable marketplace. On a non-GAAP basis, its margin enhanced to a file 53%. AMD now boasts a solid product portfolio, which will nearly definitely drive the margin more increased in the next quarters by switching its product or service mix to bigger-margin choices like EPYC, Radeon, and Ryzen.

Trying to get Alpha and YCharts

AMD’s accounting EPS and owners’ earnings

The normally quoted PE for AMD is based mostly on the GAAP accounting earnings. And as of this composing, it may differ in the vary from 19x to 37x depending on whose report you read through (e.g., Yahoo Finance or Trying to find Alpha) and the foundation of the EPS you use (yearly, TTM, FW, et al). Other than the variance, these kinds of usually quoted PE does not reflect its legitimate financial earning ability. And in AMD’s situation, the accounting earnings underestimate its genuine earning electric power by a sizable margin.

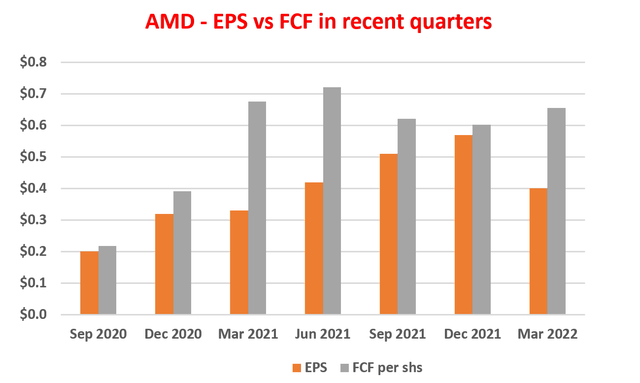

You can previously see the discrepancy by merely looking at the cost-free funds movement (“FCF”) and EPS comparison revealed in the subsequent chart. The chart exhibits the accounting EPS per share and FCF for every share for AMD in excess of the previous several quarters. You can see that its FCF has been consistently increased than EPS (i.e., and FCF-earnings conversion ratio regularly earlier mentioned 1).

In the upcoming part, we will see that even the FCF presently underestimates the genuine owners’ earnings since ALL CAPEX expenditures have been regarded a value in the calculation of FCF.

Writer based on Trying to get Alpha data

AMD’s advancement CAPEX and owners’ earnings

The essential to knowing the OE is to distinguish in between progress and servicing CAPEX. Development CAPEX is optional and really should not be regarded a value. For decades, traders like Warren Buffett have promoted this strategy. The subsequent quote from Buffett very best describes it (I included the emphasis):

These depict (“a”) reported earnings as well as (“b”) depreciation, depletion, amortization, and specified other non-money fees…significantly less (“c”) the regular once-a-year amount of money of capitalized expenditures for plant and machines, and so forth. that the company requires to entirely preserve its extended-term aggressive position and its unit volume…Our owner-earnings equation does not generate the deceptively exact figures presented by GAAP, because (“c”) must be a guess – and one particular at times very tough to make. Despite this challenge, we take into consideration the owner earnings figure, not the GAAP figure, to be the relevant merchandise for valuation functions…All of this details up the absurdity of the ‘cash flow’ figures that are frequently established forth in Wall Avenue stories. These numbers routinely contain (“a”) as well as (“b”) – but do not subtract (“c”).

Even so, estimating (“c”) is in truth tricky and will involve a additional state-of-the-art understanding and assessment of the money statements. The standard concepts and steps are thorough in my previously post on AAPL. And in this write-up, I analyzed (“c”) for AMD utilizing Bruce Greenwald’s technique (thorough in my earlier posting or Greenwald’s ebook entitled Value Investing).

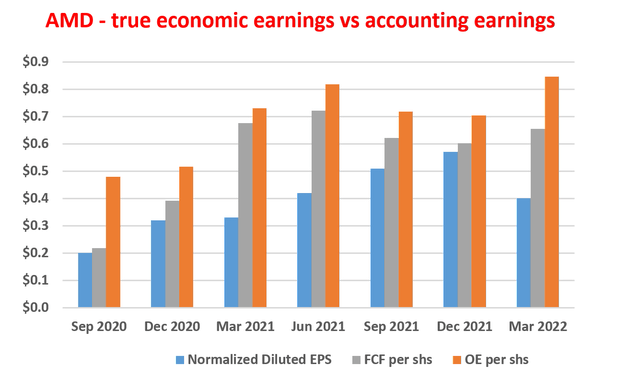

Under this history, the subsequent chart reveals AMD’s real financial earnings as opposed to its accounting EPS and FCF in recent quarters. This analysis was carried out employing Bruce Greenwald’s tactic. In figuring out the ratio of PPE (attributes, vegetation, and gear) to income ratio, I used a five-12 months shifting average. A couple of vital observations from this chart,

- AMD’s OE is appreciably bigger than both equally its FCF and its EPS. As an example, it reported EPS of about $.4 for each share very last quarter and FCF of about $.65 for every share. On the other hand, its OE is about $.85 for each share, about 30% bigger than its FCF and much more than 2x than its accounting EPS.

- The motive that its OE is substantially bigger than equally EPS and FCF is that most of AMD’s CAPEX are for growth, not routine maintenance. To me, this is a indication of a high-expansion compounder. It displays AMD can make use of significant quantities of incremental cash to go after new advancement alternatives, to be elaborated more later.

Writer centered on Trying to get Alpha knowledge

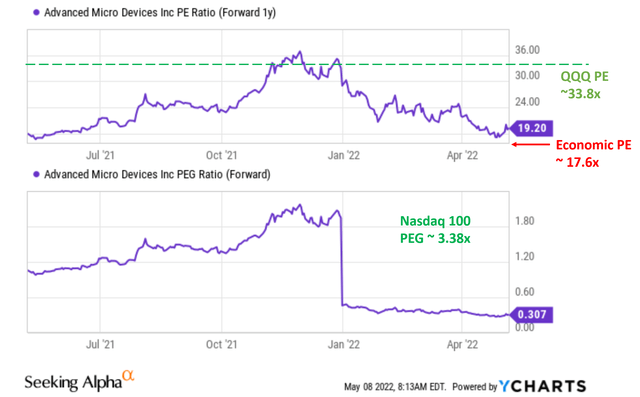

Valuation is very low and growth is even less expensive

The subsequent chart compares AMD’s present valuation towards its historical valuation and also the valuations of the general current market. At its latest price, AMD’s valuation is about 19.2x PE centered on its FW accounting EPS, presently down below its historic common and also the NASDAQ 100 index. The NASDAQ index is valued at about 33.8x PE when represented by the QQQ fund (based mostly on Yahoo Finance data). So, in relative conditions, AMD is virtually ½ of the valuation of the NASDAQ 100 index (56% to be exact). In phrases of the owners’ PE, its valuation is even decrease dependent on the higher than discussion. It is only about 17.6x.

In conditions of growth, the discount is even larger sized. As you can see from the pursuing chart, the latest PEG ratio for AMD is only about .31x. If we believe the all round stock marketplace has an yearly progress level of 10% (a generous assumption), then the latest PEG ratio for the NASDAQ 100 index would be about 3.38x, extra than 10 situations greater than AMD. AMD’s growth is too seriously discounted to disregard.

Writer and In search of Alpha details

Additional development catalysts

There are further more growth catalysts that the industry has not priced in yet, creating more probable for AMD’s financial gain to increase and margins to extend.

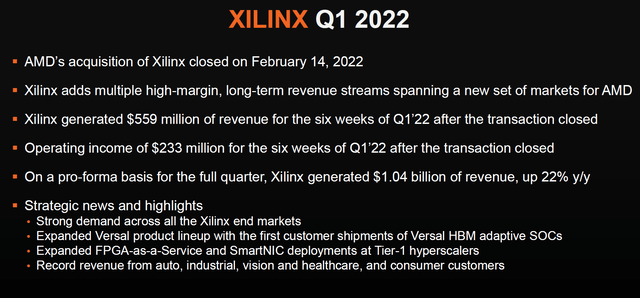

The 1st catalyst involves Xilinx acquisition. The acquisition of Xilinx by AMD was accomplished on February 14, 2022. Xilinx presents AMD with numerous large-margin, extensive-time period earnings streams throughout a new established of markets. The Xilinx acquisition not only produced fast economic positive aspects (it extra $559 million in profits for the six months after the acquisition concluded), but also designed huge lengthy-term alternatives for AMD to broaden its addressable marketplace these kinds of as Versal HBM adaptive SOCs, FPGA-as-a-Provider, 5G, and also extra futuristic AI technologies.

AMD 2022 Q1 earnings report

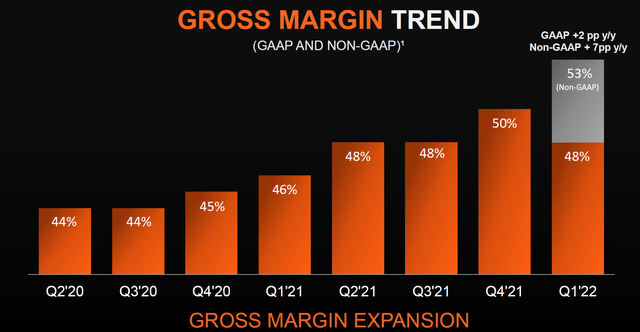

The next catalyst consists of further more margin enlargement. As you can see from the pursuing chart, its margin expanded to 50% in the past quarter of 2021 and then to a document 53% in the latest quarter on a non-GAAP foundation. As aforementioned, if the income are additional correctly interpreted to change for the expansion CAPEX investments, its margin will be by now considerably greater. AMD at present enjoys a strong product line, which is quite possible to force the margin even substantial in the next handful of quarters. The Company, Embedded, and Semi-Custom section additional than doubled its volumes in the latest quarters. It has also been experiencing enormous good results, shifting its merchandise blend to larger-margin offerings, like the EPYC, Radeon, and Ryzen strains.

AMD 2022 Q1 earnings report

Final thoughts and hazards

AMD is at present a large-development stock priced like a worth stock. Its valuation is further distorted by its hefty expenditure in expansion CAPEX. With a PEG ratio fewer than 1/10 of the all round marketplace, it is seen almost as a forever stagnating inventory. All its negative scenarios have been thoroughly priced in, and positive situations have been discounted or even discarded. Vital in close proximity to-term catalysts, the Xilinx synergies, and more margin expansions generate pretty favorable and asymmetric return/hazard profiles.

At last, AMD expense will involve both of those quick-term and extended-expression risks. In the close to phrase, AMD faces marketplace demand from customers renormalization threat. In the submit-COVID market, Pc desire is dropping and may well dampen demand from customers for AMD chips. Persons alter their performing practices amid the COVID epidemic and elevated Laptop demand from customers. Now world wide Pc demand from customers is exhibiting signs of renormalization. Also, in the extensive term, AMD faces competition and pricing energy dangers. AMD continually competes with other firms (these kinds of as Intel (INTC), NVIDIA (NVDA), QUALCOMM (QCOM), et al) in the chip space to make smaller sized, more quickly, and cheaper goods. The levels of competition can even further prolong to other spots these as producing and its console organization.

More Stories

Three Keys of Branding That Will Turn Small Business Advertising Expense into an Investment

Perbedaan Logo Design Dengan Branding

Travel Agents Can Help With Vacations and Business Travel