DNY59/E+ through Getty Illustrations or photos

Exactly where is inflation going?

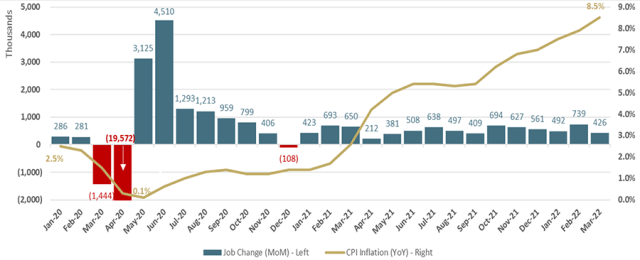

US inflation hit 8.5% in March and is now at a 40-yr higher. COVID-19-related offer chain challenges mixed with the Russia-Ukraine war have pushed electrical power costs up a staggering 32% in the newest report. And food items selling prices are subsequent, up 8.8% – the biggest soar given that 1981. Shoppers almost everywhere are emotion the squeeze, and many analysts are predicting a US recession.

With very good cause, the US Federal Reserve is apprehensive.

To suppress inflation, the Fed started a mountaineering cycle at the FOMC assembly previous March, elevating the federal money rate 25 foundation factors (bps). And it has just shipped what the marketplace expected at the newest assembly on 5 May: a 50 bps level hike. That is far more intense than the initial hike and reveals just how alarmed the central lender is about the evolving inflation outlook.

But what will come future? The market is speculating wildly. Issues abound about the depth of more charge hikes and whether or not the economic system can withstand a fifty percent-dozen will increase this calendar year without the need of sliding into economic downturn. On the other facet of the coin, fears of runaway inflation emphasize the risk of being caught guiding the curve. For inflation hawks, catching up by using aggressive fee hikes is an absolute requirement.

CPI Inflation and Career Gains

US Bureau of Labor Data

The Fed’s choices will substantially influence the outlook for corporations and traders alike. So, how can we hedge this uncertainty?

Amid rampant inflation and climbing interest premiums, economical chance administration is significant. We need to guard ourselves from curiosity rate volatility, from expected and unanticipated hikes. But how? And specified how speedily brief-term charges have spiked, is it also late to hedge our floating personal debt? How can we prioritize economical risk-administration aims?

Really don’t Obsess Over Sector Developments

Interpreting the Fed’s tone close to possible amount hikes shouldn’t be the most important emphasis. As a substitute, we have to have to seem nearer to home – at our firm’s hazard profile. The much more leverage on the equilibrium sheet, the tougher charge hikes and shocks will be to soak up. Nonetheless good possibility administration delivers both proactive and reactive actions to hedge these types of market place threats.

Considering the fact that January 2012, the Fed has produced interest level anticipations each quarter. The so-named Dot Plot shows the Fed’s expectations of the essential brief-phrase interest charge that it controls for the up coming 3 decades and the extended term. The dots exhibit just about every Fed member’s nameless vote on the predicted charge motion.

While these only guide the Fed’s actions, some companies mistakenly rely on them to notify their hazard administration and hedging decisions. But waves of crises and surprising gatherings routinely batter the plots and frequently establish them erroneous: In March 2021, for illustration, most Fed users predicted zero level hikes in 2022 and 2023!

Only a yr later, the March 2022 Dot Plot showed a massive change in Fed expectations: from March 2021 forecasts of zero fee hikes in 2022 to forecasts in March 2022 of 6 hikes in 2022. And due to the fact then, the Fed’s tone has only grown a lot more hawkish. We shouldn’t fixate on what the Fed claims it will do it really probable will not likely do it.

Realize Your Financial debt Exposure And Sensitivity To Desire Charge Actions

All companies should very carefully strategy their present and upcoming debt specifications. Taking care of financial hazards turns into more simple with a very clear personal debt system.

But whether it truly is to fund an acquisition, refinance a loan, or support formidable funds expenditure, the hedging strategy necessitates the utmost awareness. Immediately after all, if the pandemic has taught us anything, it is that the long run is radically unsure.

As part of the hedging evaluation and feasibility approach, a organization ought to make fair anticipations for the length, amortization strategy, and floating curiosity fee index and assess the applications obtainable to implement its meant hedging tactic.

With Hedging Solutions, Go Outdated School!

Picking the hedging instrument requires large scrutiny and thorough criteria to cut down and mitigate the market hazard arising from the interest amount publicity. We can lower chance by making an offsetting place to counter volatilities exhibited in the hedged item’s honest worth and cash flows. This may mean forgoing some gains to mitigate that danger.

It is often advisable to stick to the vanilla devices to hedge our credit card debt. These involve curiosity level swaps and fascination amount caps. Long run personal debt can also be hedged with reasonable assurance of the anticipated debt. A forward-starting up desire level swap (just scheduling a preset swap charge in the upcoming), an fascination price cap, and other basic hedging instruments can carry out this.

The much more sophisticated a hedging instrument turns into, the far more troubles it introduces on pricing transparency, valuation criteria, hedge accounting validity, and overall success. So, we should keep it as very simple as we can.

It Is Not possible To Time The Marketplace

“Timing the market is a fool’s recreation, while time in the market place will be your best pure edge.” – Nick Murray

The previous assertion applies to danger administration. Firms must keep away from attempting to resolve for the most effective hedge entry position. Instead, we must act based on pre-established aims, danger tolerance, hedging parameters, and a governance framework.

Take into account the existing fascination level surroundings. In businesses that are delicate to greater desire fees, management may consider that level hikes are currently reflected, or priced in, in the present marketplace amounts. Administration may perhaps not imagine that the desire amount curve will be much more pricey in the upcoming and may possibly consider acquiring a hedge is avoidable.

Nevertheless, there are hedging goods that provide much more flexibility in the course of decreased charge environments while also giving safety on the upside. A hedging coverage governs all these factors in more depth and delivers administration with the necessary direction to stay away from relying on subjective and individual decisions.

Why Is Hedge Accounting Important?

When using hedging instruments to safeguard the organization from unfavorable marketplace movements, the accounting implications are important.

Properly implementing hedge accounting requirements lowers the volatility of fiscal statements in the firm’s bookkeeping. Hedge accounting helps reduce the income and reduction (P&L) assertion volatility established by repeated adjustment to a hedging instrument’s reasonable value (mark-to-sector – MTM). The crucial conditions of the hedged product (the personal debt) and its involved hedging instrument (financial derivatives) should really match.

Hedge accounting follows a perfectly-outlined accounting typical that must be utilized for a prosperous designation. Or else, the hedging instrument’s fair price would immediately impact the P&L statement. Some institutions prioritize accounting implications more than the financial rewards and vice versa. The hedging policy need to address what arrives very first in phrases of prioritization.

Takeaways

In unsure periods like these, there are a great number of perspectives about the way of potential marketplace movements. The inflation hawks are turning out to be a lot more hawkish, even though the doves continue being organization in their bearish stance.

Organizations and traders alike experience the gains of a right economic hazard management system throughout very good and lousy situations. These types of preparation mitigates the outcomes of our particular cognitive biases and makes sure sustainability and endurance all through the most tough industry problems.

Though we simply cannot and should really not hedge everything, seem setting up cultivates a tradition of chance management across the whole corporation. In the long run, on the other hand, the board of directors and the govt workforce are dependable for location the tone.

Again, Nick Murray delivers some knowledge:

“All economical achievement comes from acting on a approach. A good deal of financial failure will come from reacting to the industry.”

Disclaimer: Make sure you observe that the information of this site must not be construed as expenditure tips, nor do the views expressed essentially reflect the sights of CFA Institute.

Editor’s Observe: The summary bullets for this posting ended up decided on by Seeking Alpha editors.

More Stories

How Many Business Cards Should You Order?

Quick Guide to Implementing Business Intelligence, Data Warehousing & BPM

How to Start a Foreclosure Cleanup Business “On the Cheap”