Impression source: Getty Illustrations or photos

Study how to work out and review working financial gain as properly as why it’s the beloved revenue statement variety of a lot of professionals. Can this metric support you better visualize your business’s finances?

“It’s all about the base line.” You’ve possibly heard that phrase a ton in your occupation, but at times it is a lot more about the middle line.

Today, we’re heading to talk about working profit and why it is a preferred earnings assertion metric of numerous valuation industry experts and personal equity firms.

Overview: What is working profit?

Functioning revenue, or running money, is what’s left of profits after subtracting out cost of items sold and all running expenses. Working expenditures are the regular charges for overhead that come about executing small business. Factors like taxes and curiosity are not thought of running bills.

Speaking of taxes and desire, an additional name for working financial gain is earnings right before curiosity and taxes (EBIT). It truly is probable to estimate working earnings by including curiosity and taxes to net revenue and this strategy is a very little much easier than accounting for numerous distinct types of costs.

Observe that the EBIT formulation does not include things like other earnings and charges so it can change from running income.

Why is working profit vital?

Working gain is an significant metric to consider mainly because it displays you the financial gain of your business enterprise without the need of the effect of taxes or the money construction.

If you have tax decline carryforwards or sizeable debt, your net money will be affected by people figures and won’t be a best illustration of how nicely your company is functioning.

3 benefits of calculating operating financial gain

Let us consider a handful of of the rewards of calculating functioning gain.

1. Management fastened fees

Accountants like to break up expenses into two classes: mounted and variable. Set fees are bills that never alter based on earnings. Charges like hire, coverage rates, and the salary for business office personnel remain the similar no make a difference how a lot you improve or reduce product sales.

Most variable charges conclusion up in charge of merchandise bought. These are expenditures this kind of as the charge of elements and the pay that goes to production workforce.

Examining functioning financial gain from year to calendar year will enable you know if you require to adjust set costs. If your revenue is tapering off, you may see falling running income margin, signalling that workforce require to be laid off or that you will need to downsize your workplace room.

If the opposite takes place and working income are increasing quicker than profits, it could be time to open a next site or employ the service of a lot more again-place of work guidance.

2. Compare throughout business and 12 months

It is tricky to assess internet income from calendar year to 12 months or to corporations in distinct industries. Your small business may have had a windfall a single-time achieve of $50,000 a person yr and a organization in a different sector could need to have to load up on debt for money expenditures.

Functioning income will eliminate all those expenditures not right tied to the operations of the business enterprise and give you a far better feeling of exactly where you stand.

3. Benefit your company

For the causes we just discussed, personal equity prospective buyers and other men and women who order compact organizations prefer to use working revenue to benefit companies.

It is a superior exercise to do a back again-of-the-envelope valuation of your enterprise just about every yr to see if you’re on monitor for retirement or if you really should think about growth.

An instance of calculating functioning gain

Let us look at an illustration of operating profit for Electronic Arts (EA). It is not accurately a compact company, but it’s a single whose items I have used often for the duration of the COVID-19 pandemic and its financials operate for our analysis.

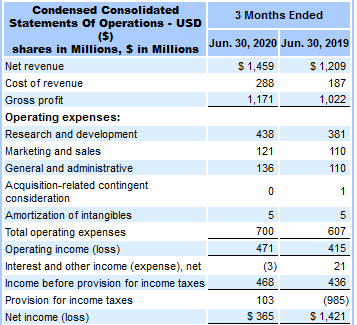

Electronic Arts had working revenue of $471 million. Image supply: Writer

Digital Arts had an over 20% increase in earnings from Q2 2019 to Q2 2020, but web earnings fell from more than $1.4 billion to $365 million. By on the lookout closely at the functions statement, we can see that destructive tax expenses in 2019 distorted the net earnings number and built it useless for evaluating one particular 12 months to the upcoming.

Due to the fact of this tax situation, functioning income was a significantly improved measure of company accomplishment concerning the two quarters. It grew about 13.5%.

The following stage in the assessment is to pinpoint why operating profit grew considerably less than earnings. The most significant section of running gain calculation, running costs, grew by 15%, led by a shut to $60 million bounce in study and advancement expenses.

This suggests the corporation grew earnings at a more rapidly fee than overhead. And price tag of goods sold grew by 54% from 2019 to 2020.

Working with running profit investigation, we’re ready to pinpoint the runaway expansion in a essential price. If you had just focused on net gain, you would inevitably get to the correct respond to since the web revenue collapses from 2019 to 2020 as very well.

But had the adverse tax price been in 2020, it’s probable the bottom line would’ve just demonstrated a massive boost and who would like to dig into a big raise?

FAQs

-

All 3 of these metrics are generally applied to evaluate enterprises.

Operating dollars circulation is noted on the cash circulation statement. This assertion is not necessary in tax returns, so you may possibly have under no circumstances observed a person if you have not exclusively printed it out on your accounting software program.

Working dollars stream involves tax, curiosity, and a person-time merchandise, but it does not include non-dollars bills, these as depreciation and amortization.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a blend of operating financial gain and running funds movement. It does not include things like fascination and taxes, and it doesn’t incorporate non-money charges. EBITDA permits you to assess the money your enterprise attained and assess from year to yr.

-

Tax expenditure is calculated 1 move after functioning earnings. Here is the accounting equation to get from functioning profit to pre-tax income:

Running Revenue – interest cost +/- Other cash flow/fees = Pre-Tax Earnings

-

There are two most important levers to raise functioning earnings: lower set charges and improve markup.

Cutting down fixed expenditures indicates making your overhead far more effective. Cease spending for software package you have not applied in a long time. Downsize your developing or have people today work from property when feasible.

Markup is the change among what you fork out for products and what you promote them for. It’s achievable the industry will not bear an boost in markup, but it may make feeling to take a look at it on some revenue.

Increase functioning income to your resource upper body

No conclude-all metric will notify you every thing about how your business enterprise is operating. Earnings does not inform you how economical you ended up. Web revenue includes some non-running bills.

Even functioning profit includes some non-income expenditures. The important is to keep observe of a range of figures and drill down into everything that does not glimpse appropriate.

More Stories

How Graphic Design Can Bring Benefits to Your Brand

Personal Branding – So What Is The Big Deal?

Three Keys of Branding That Will Turn Small Business Advertising Expense into an Investment