The Worst Years Ever For a 60/40 Portfolio

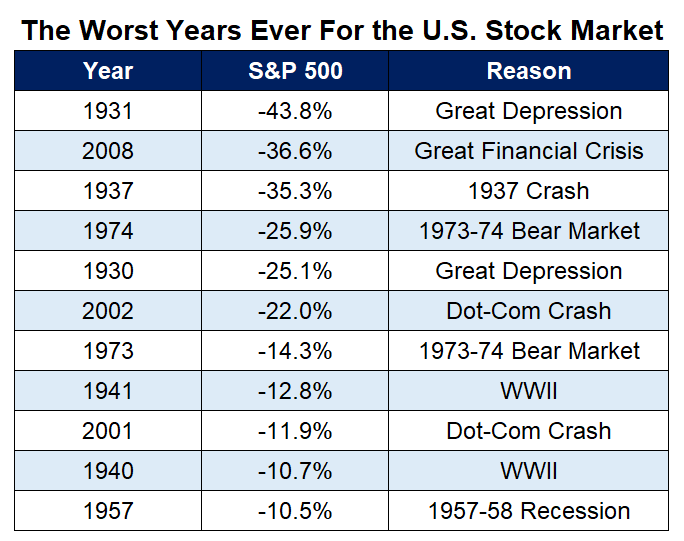

In a new piece I appeared back again at the worst years in stock current market history since, properly, so much this is one particular of the worst years in stock market place history.

If the year ended now, we would be somewhere amongst 1973 and 1941.

As a lot of of my astute readers pointed out, the rational comply with-up here is to glance at the worst several years for a a lot more diversified portfolio to see the worst-situation circumstance for a 60/40 portfolio.

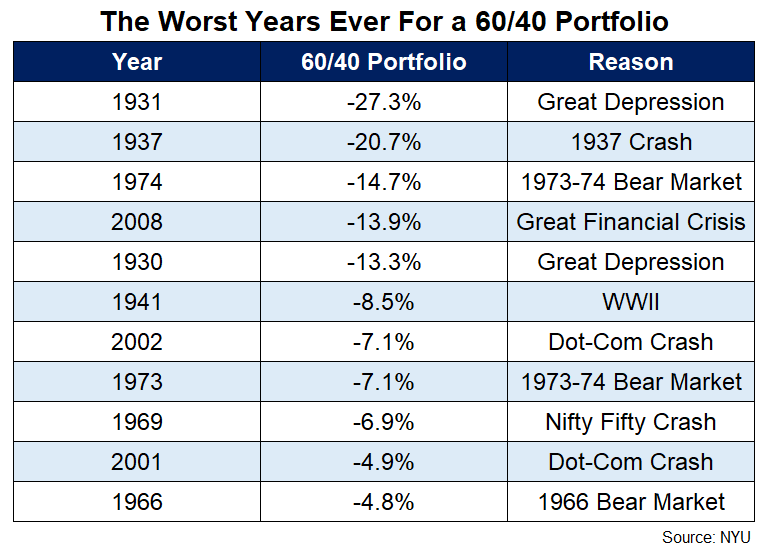

Let’s seem at the worst calendar year returns for a U.S. 60/40 portfolio1 heading back again to 1928:

A lot of of the worst many years for a 60/40 portfolio are the very same as the worst decades for the U.S. stock marketplace, which would make perception due to the fact the 60 carries considerably far more hazard than the 40 in this equation.

And although the latest 13% and improve loss in the S&P 500 calendar year-to-day would be the eighth-worst calendar year return given that 1928, it’s even even worse for the 60/40 correct now.

If the 12 months were to end now, the current year-to-date return of -12.1% for a 60/40 portfolio would be the sixth-worst yearly return in excess of the previous 100 many years or so.

Because bonds are getting these a rough go at it during a correction in the inventory current market, this yr is now on par with 60/40 returns in 2008 and 1930.

Not the sort of firm you want to hold.

Of program, we’re only 5 months into the year. And even if the year ended up to finish where we are appropriate now (or worse), it is just a single year.

You really should be expecting to have poor several years when investing since investing is not always uncomplicated in the limited-time period.

What about the extended-time period returns (the only kinds that seriously subject)?

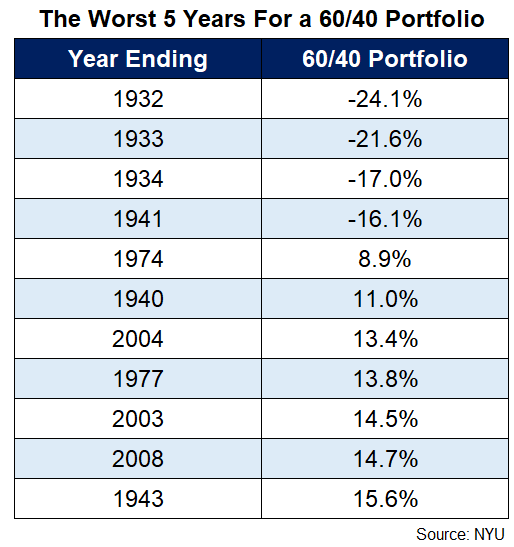

These are the worst 5 yr returns for a 60/40 portfolio:

So we’re searching at 4 instances around a 5 12 months period when 60/40 was adverse above 5 a long time and they all happened in or all over the Great Depression.

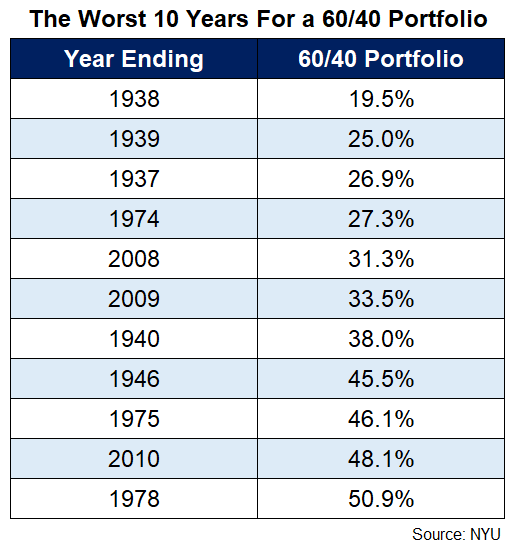

Now let’s go out 10 decades:

By my calculations, there has under no circumstances been a destructive return above 10 several years for a 60/40 portfolio as of a calendar 12 months-finish.

Could it come about?

Definitely.

There is no such issue as generally or in no way in the economic markets.

However, which is a pretty respectable observe document.

How about one particular much more?

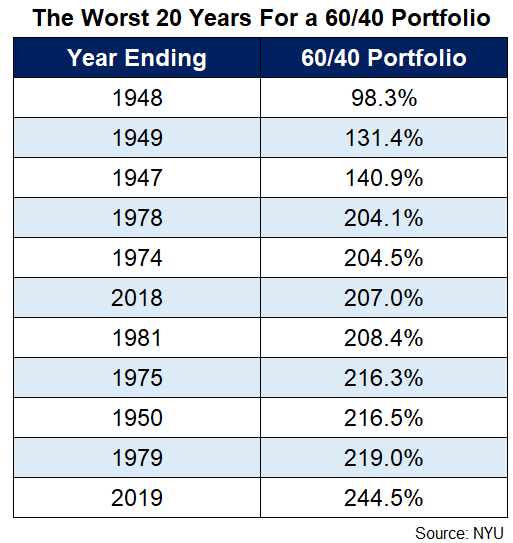

Here are the worst 20 yr returns:

As with most worst-situation historical effectiveness figures, the beginning point for the bottom of the barrel was 1929.

It is appealing the years ending 2018 and 2019 are on this record. The top of the dot-com bubble was not a great entry level possibly.

It is really worth pointing out that the range of annual returns for the worst 20 several years listed below for a 60/40 portfolio is 3.4% to 6.%.

I’m not accounting for fees or taxes or inflation here but this is however quite good for a worst-case circumstance, suitable?

I marvel how many traders would signal up for a assured 6% per calendar year for the following 2 decades right now.

Previous overall performance is not indicative of foreseeable future returns and all that but from time to time it is useful to zoom out a tiny little bit when you’re in the midst of a terrible year.

Extending your time horizon continues to be one of the most impressive expense techniques when all else fails.

Even more Reading through:

The Worst Yrs Ever in the Inventory Marketplace

1The 60/40 portfolio here is 60% in the S&P 500 and 40% in 10 Year Treasuries through knowledge from NYU that I use consistently. All of the returns in this submit are calendar year-close functionality quantities.