HJBC/iStock Editorial via Getty Images

Introduction

France-based TotalEnergies SE (NYSE: NYSE:TTE) released its first-quarter 2022 results on April 28, 2022.

Note: I have followed TTE quarterly since 2017 with 21 articles and counting. This new article is a quarterly update of my article published on March 21, 2022.

CEO Patrick Pouyanné said in the conference call:

The consequences of Russia’s actions are going beyond the Russian related businesses and will have a significant impact on the global economy, potentially more serious than the COVID pandemic and related shutdowns. The immediate impact, of course, has been the significant disruptions to energy markets that pushed oil prices above $100 per barrel and gas prices in Europe and Asia to more than $30 per million BTU.

1 – 1Q22 results snapshot

TotalEnergies reported first-quarter 2022 adjusted net income of $8.977 billion or $3.40 (€3.03) per share, beating analysts’ expectations. It was well above the year-ago $1.10 (€0.91) per share.

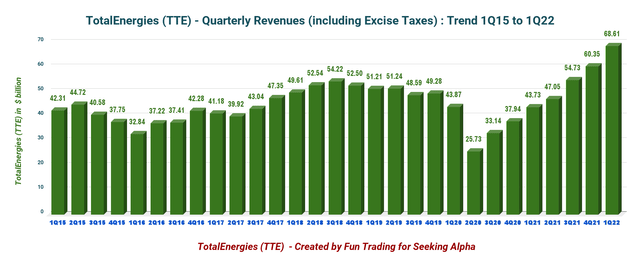

The total revenues came in at $68.61 billion, up 56.9% from $43.73 billion in the year-ago quarter. Substantial revenues were generated from record-high liquids and gas prices.

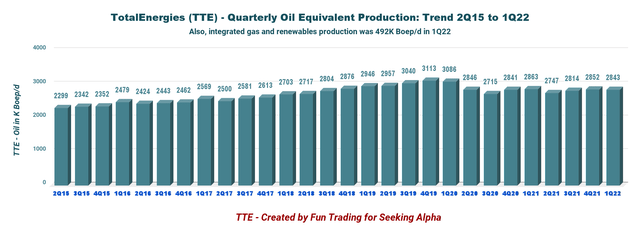

First-quarter upstream equivalent production averaged 2,843k Boepd, down 0.7% year-over-year. The decrease was due to the price effect, the natural decline of fields, the end of Qatargas 1 operating license, and the Utica asset sale.

The production of the iGRP segment (Integrated Gas, Renewables, and Power) was 492K Boep/d compared to 518K Boep/d in 1Q21.

Finally, on the Russian business front, TotalEnergies announced on March 22, 2022, that:

given the uncertainty created by the technological and financial sanctions on the ability to carry out the Arctic LNG 2 project currently under construction and their probable tightening with the worsening conflict, TotalEnergies SE had decided to no longer book proved reserves for the Arctic LNG 2 project.

As a result, TotalEnergies has decided to record in its accounts, as of March 31, 2022, an impairment of 4.1 B$, concerning notably Arctic LNG 2.

2 – Investment Thesis

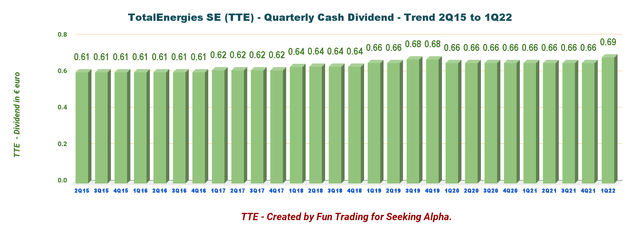

TotalEnergies SE is one of my long-term preferred oil investments primarily adapted to savvy investors interested in a steady income through sizeable dividends. TotalEnergies SE is one rare European oil major that has paid a stable dividend even during the last oil crash and increased it to €0.69 per quarter in 1Q22.

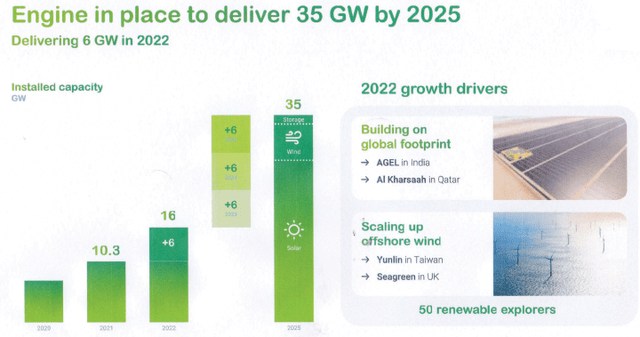

One substantial advantage of TotalEnergies is that the company’s strategy is shifting to renewables more smoothly than most competitors. While focusing on its traditional oil and gas business, it is also growing its presence slowly in “green electricity generation,” which is gaining momentum and will take a significant position less than a decade from now.

Per Reuters, TotalEnergies says that by 2030 its sales of oil products will drop to 30% of revenues, against 50% for gas and 15% for electricity. For instance, on May 25, TotalEnergies took a 50% stake in wind and solar farm developer Clearway Energy Group in a deal worth $2.4 billion.

Total has been building up its US renewable assets in the past year, with a portfolio that includes 8 gigawatts of large-scale solar projects bought from SunChase, the recent acquisition of Core Solar and the development of 4GW of wind projects off the coasts of New York and North Carolina.

However, even if the oil prices outlook looks solid, we do not know how long it will last this time and it may have reached a plateau. So, it is not wise to recommend adding to your position at the moment. Instead, it is perhaps time to take some partial profits.

Thus, it is essential to trade short-term LIFO about 30%-40% of your TTE holding and keep a long-term core position for a higher target. This dual strategy entitles you to take full advantage of the oil and gas sector’s high volatility and inherent cyclicity. It is what I recommend in my marketplace, “The Gold and Oil Corner.”

3 – Stock performance

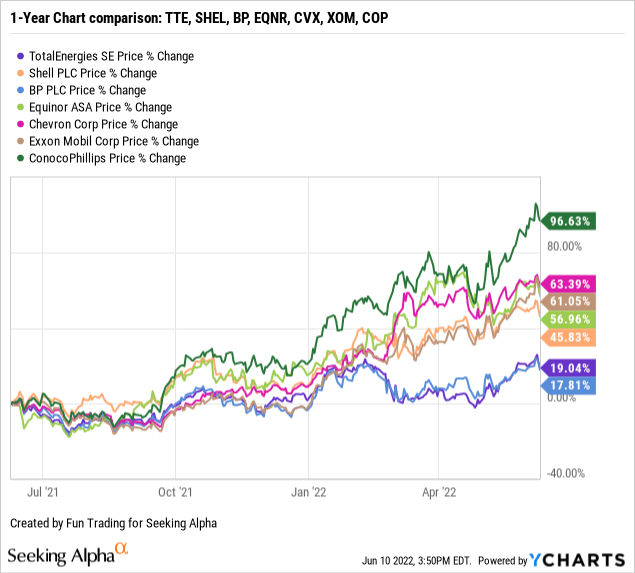

TotalEnergies has underperformed the group, which includes Shell (SHEL), Equinor (EQNR), U.K.-based BP (BP), as well as US majors Chevron (CVX), Exxon Mobil (XOM), and the large E&P ConocoPhillips (COP).

TotalEnergies SE is up 19% on a one-year basis despite a massive rally in oil prices. This performance pales in comparison to ConocoPhillips, up now 97%.

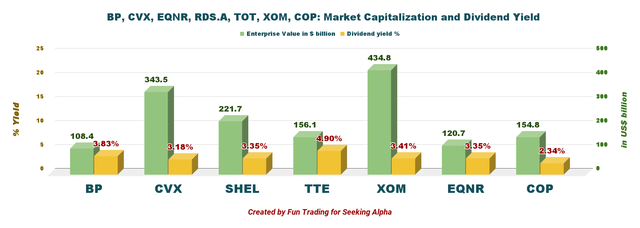

4 – Dividend comparison with its peers – TTE now pays a quarterly dividend of €0.69 per share.

TTE: Dividend comparison (Fun Trading)

TotalEnergies: Balance Sheet and Production in 1Q22: The Raw Numbers

Note: TTE is an American Deposit Receipt or ADR. The Foreign withholding taxes reduce the dividend paid to American investors (25% or 12.8% depending on your account type. In general, 25%). However, the foreign tax paid can be deducted partly from your income tax. Ask your Financial Adviser about your case.

| TotalEnergies SE | 1Q21 | 2Q21 | 3Q21 | 4Q21 | 1Q22 |

| Total Revenues in $ Billion | 43.73 | 47.05 | 54.73 | 60.35 | 68.61 |

| Total Revenues (minus excise tax) in $ Billion | 38.63 | 41.63 | 49.07 | 55.30 | 63.95 |

| Net income in $ Billion | 3.34 | 2.21 | 4.65 | 5.84 | 4.94 |

| EBITDA $ Billion | 8.99 | 7.70 | 11.26 | 14.26 | 14.90 |

| EPS diluted in $/share | 1.23 | 0.80 | 1.71 | 2.17 | 1.85 |

| Cash from operating activities in $ Billion | 5.60 | 7.55 | 5.64 | 11.62 | 7.62 |

| Capital Expenditures in $ Billion | 2.41 | 2.68 | 2.72 | 4.54 | 3.46 |

| Free Cash Flow in $ Billion | 3.19 | 4.89 | 2.92 | 7.08 | 4.16 |

| Total Cash $ Billion | 34.89 | 33.05 | 32.88 | 33.66 | 38.69 |

| Long-term Debt in $ Billion | 73.01 | 69.31 | 67.28 | 64.55 | 64.80 |

| Dividend per share in €/sh (including tax 12.8%) |

0.66€ |

0.66€ |

0.66€ |

0.66€ |

0.69€ |

| Shares outstanding (diluted) in Billion | 2.697 | 2.758 | 2.701 | 2.690 | 2.644 |

| Oil Production | 1Q21 | 2Q21 | 3Q21 | 4Q21 | 1Q22 |

| Oil Equivalent Production in K Boepd | 2,863 | 2,747 | 2,814 | 2,852 | 2,843 |

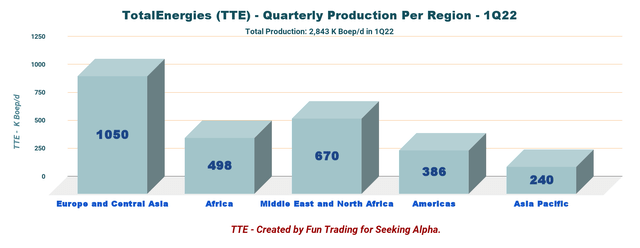

| Americas Production in K Boepd | 376 | 378 | 372 | 363 | 386 |

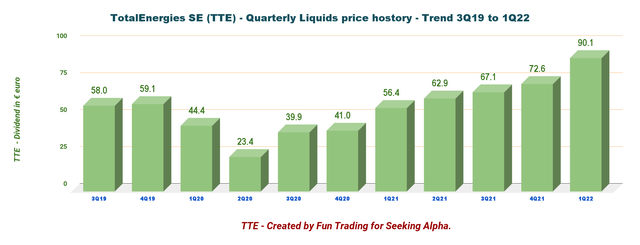

| Average price liquids $/Boe | 56.4 | 62.9 | 67.1 | 79.8 | 90.1 |

| Average gas price $/Mbtu | 4.06 | 4.43 | 6.33 | 11.38 | 12.27 |

Source: Company filings and Fun Trading

Note: More data (2015) are available for subscribers only.

Analysis: Balance sheet and production discussion

1 – Total revenues were $68.61 billion (including excise tax) in 1Q22

TTE: Quarterly Revenues history (Fun Trading)

Net earnings were $4,944 million, up from $3,344 million in 1Q21. The company indicated a profit of $1.85 per diluted share.

TotalEnergies acquired $1,400 million worth of assets and sold assets for $478 million in 1Q22.

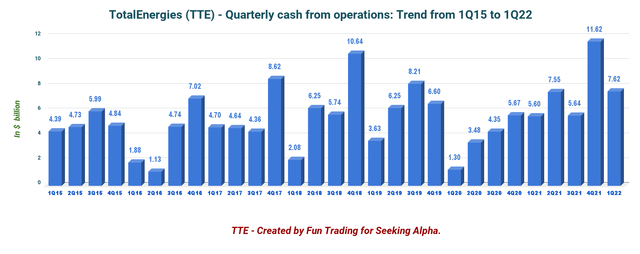

Below is a history of the cash flow from operations since 2015.

TTE: Quarterly Cash flow from Operations history (Fun Trading)

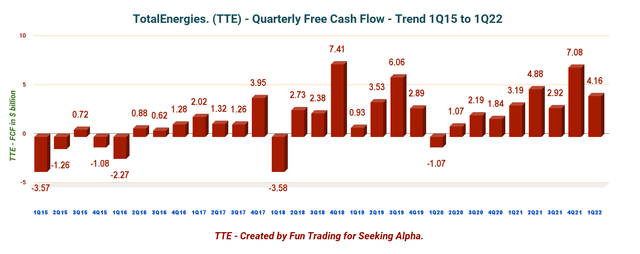

2 – Trailing 12-month free cash flow (“ttm”) was $19.03 billion with $4.16 billion in 1Q22

TTE: Quarterly Free cash flow history (Fun Trading)

TotalEnergies trailing 12-month Free cash flow is now $19.03 billion, with $4.16 billion realized for 1Q22.

The company pays about ~$7 billion in dividends annually, primarily covered by free cash flow.

TotalEnergies announced an increase of 5% of its quarterly dividend to €0.69 ($~0.7263). However, for US investors, you will receive only 75% of this amount due to the French withholding tax. In some cases, you can receive 0.872%. The dividend yield NET is still between 3.8% and 4.4%. Ask your broker.

TTE: Quarterly dividend in € history (Fun Trading)

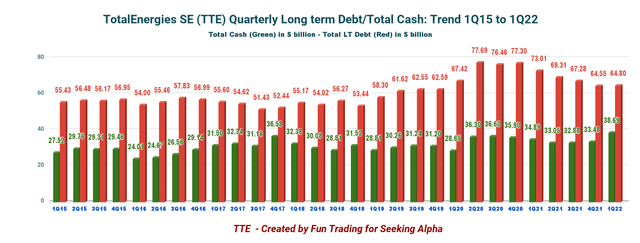

3 – Net debt was $26.1 billion as of the end of March 2022

TTE Quarterly Cash versus Debt history (Fun Trading)

The debt-to-equity ratio is now 0.56, according to YCharts, and the net debt to capital was 12.5% at quarter-end.

TTE indicates a net debt of $17.053 billion using another method. I have done a more general calculation from the LT Debt, including current minus total cash, which is a more comparable value with other oil majors.

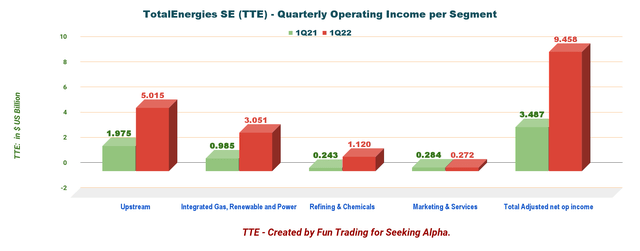

4 – Details: TTE operates four different segments

Total operating income was $9,458 million this quarter, up from $3,487 million last year.

TTE Quarterly Operating income per segment 1Q21 versus 1Q22 (Fun Trading)

4. 1 – Exploration & Production (Upstream)

The operating gain was $5,015 million, up significantly from $1,975 million last year.

4.2 – Integrated Gas, Renewable, and Power

Operating income was $3,051 million, from $985 million last year.

4.3 – Refining and Chemicals

Operating income was $1,120 million from $243 million in the year-ago quarter.

4.4 – Marketing and Services

Operating income was $272 million, down from $284 million in 1Q21.

5 – 1Q22 Oil Equivalent Production up to 2,843K Boepd from 2,841K Boepd last year.

5.1 – Oil equivalent production history

TTE: Quarterly oil and gas history (Fun Trading) TTE Liquids price history (Fun Trading)

The realized gas prices increased from a year-ago quarter of $4.06 to $12.27 per thousand British thermal units in Q1. Realized LNG prices improved from the prior-year quarter to $13.60 per thousand Btu from $6.60.

Upstream output comes primarily from Europe and the Middle East. Total SE has a small production from the Americas.

TTE Quarterly Oil equivalent Production per Region (Fun Trading)

5.2 – 2Q22 Guidance

TotalEnergies expects second-quarter production to increase from the output in Brazil, with the startup of Mero 1 and its entry into Atapu and Sepia.

The company forecasts average LNG prices to remain at a high level of $14 per thousand Btu in the second quarter of 2022.

TotalEnergies set a total CapEx of $15 billion in 2022, with 25% allocated to strengthen renewables operation and electricity generation further.

TotalEnergies indicated that the ongoing War in Ukraine resulted in a loss of 2k-3k barrels of oil per day from Russia and lower output from Russian refineries.

5.3 Renewable by 2025: The goal is to deliver 35 GW

The company expects to be a significant player by 2025.

TTE Renewable Presentation 2025 (TotalEnergies)

Technical Analysis and Commentary

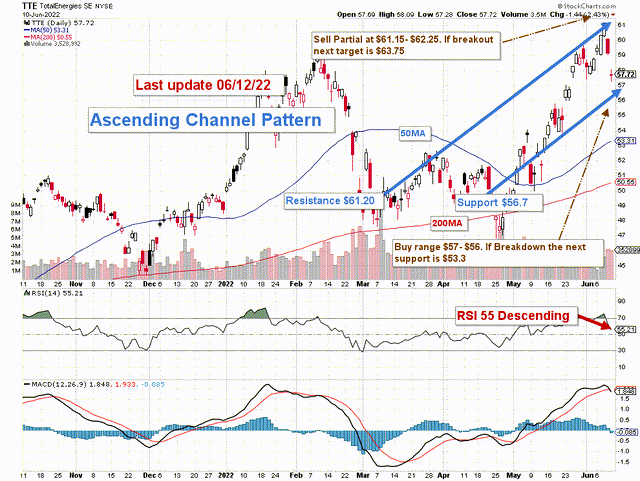

TTE: TA Chart short-term (Fun Trading)

TTE forms an ascending channel pattern (short-term) with resistance at $61.2 and support at $56.7. The trading strategy is to sell about 30%-40% of your position LIFO between $61.15 and $62.25 and wait for a retracement between $57 and $56.

However, oil prices have reached an unsustainable level, creating elevated inflation that could derail the world economy and trigger a recession. The recent CPI numbers are pretty obvious.

The direct effect of this simple equation is that we are now heading for a recession which will affect the oil and gas demand. Either way, oil will have to come down from this overheated situation, and oil stocks will drop in correlation.

In this case, TTE will likely drop to its 50MA at $53.3 or even below $51.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States by Generally Accepted Accounting Principles (GAAP). Therefore, only US traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stock, one for the long term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below to vote for support. Thanks.

More Stories

Three Keys of Branding That Will Turn Small Business Advertising Expense into an Investment

Perbedaan Logo Design Dengan Branding

Travel Agents Can Help With Vacations and Business Travel