Income or hourly? How really should you shell out your personnel? This piece discusses the components to take into account when determining amongst the two.

Is hourly or income greater?

Looks like a uncomplicated plenty of issue, but it is a tough just one to respond to.

No matter whether you can keep skilled staff and bring in leading skills hinges, in section, on how your business constructions the employee payment prepare. Pay only for hours labored and you may possibly turn off top rated candidates. Pay back anyone a certain month to month income and you may perhaps be jeopardizing your company’s economic health, which is harmful to staff occupation protection in the extended operate.

In this manual, we’ll talk about the change in between hourly and wage pay out and the variables to consider when deciding how to pay an staff.

What is salaried shell out?

A salaried employee is paid out a preset sum for providers rendered. They gain a regular paycheck. Some obtain a biweekly spend, though other people get compensated every month.

An employee who’s paid a income can be classified as an exempt staff (far more on this later on), furnished they satisfy certain conditions. Exempt personnel get no time beyond regulation fork out and may well at times have to function a lot more than 40 several hours a week, such as throughout the fast paced tax period in the circumstance of accounting professionals.

There are selected rewards to spending your staff a income. People appear at salaried positions as extensive-term occupation solutions with higher odds for progress. Month-to-month salaries are noticed as a secure supply of earnings, which is 1 of the major reasons staff adhere close to more time.

What is hourly fork out?

Hourly pay back, as the title implies, is for staff members who are paid out by the hour. How a great deal they generate depends on the number of hours worked within just a certain fork out period of time, which is typically the preceding week. For instance, an inside designer who puts in 10 hrs of do the job on a career will be paid their hourly level multiplied by 10, though a component-time info encoder who performs four hrs every single day from Monday to Friday will be compensated their hourly fee moments 20 several hours.

Variables impacting hourly rate levels are diverse and include things like the mother nature of the function, get the job done ailments, the employee’s expertise, and schooling or instruction. A minimum amount wage charge is also adopted for every point out.

Although hourly staff members generally get paid much less than their salaried peers, they can get paid overtime, which is 1.5 moments their hourly amount for every single hour in excessive of the regular 40 hrs per week. Indicating, if they perform a great deal of time beyond regulation, they can make more than the salaried workforce who are not entitled to additional time pay.

Wage vs. hourly fork out: What’s the distinction?

Concerning salaried and hourly employees, the latter have far more command over their schedules. As this sort of, if their plan enables, they can function on other work or projects. Most hourly workers are non-exempt, which means beneath the Truthful Labor Requirements Act (FLSA), employers are needed to shell out them a least wage furthermore extra time.

Nevertheless, there are also exempt hourly employees, this sort of as truck drivers, film theater personnel, and agricultural staff. Be guaranteed to assessment relevant federal and condition rules to be on the harmless facet.

Salaried workers are compensated a set quantity for every year or for each week. They are also probable to obtain rewards this sort of as paid out unwell and trip days, and as they move up the occupation ladder, they normally turn out to be suitable for additional and much better advantages. Some salaried workforce are non-exempt, e.g., selected secretaries or nurses, which indicates that if they perform in excessive of 40 hrs for every 7 days, they will be compensated for time beyond regulation.

Most salaried workforce, generally those people in managerial or administrative positions, are exempt workers, which means they are exempt from the security afforded by the FLSA to non-exempt employees. As we have now mentioned, they do not get payment for overtime and holiday function. In other phrases, they get compensated for having the task performed, not for the quantity of hrs worked.

You may be thinking, “I ought to just shell out everyone a income and classify them all as exempt since they get the job done 40 several hours for each 7 days bare minimum in any case. This way, I really do not have to stress about additional time pay back or tabulating each employee’s total several hours at the conclusion of the week.” Regretably, this is not a final decision you can arbitrarily make.

There are procedures to abide by when classifying workers as exempt. The requirements may well change from state to state, but instance situations are:

- If their position description falls below the following groups: administrative, executive, specialist, exterior profits, or pc

- If they handle at the very least two employees and can retain the services of or fireplace all those very same staff

- If they can make impartial decisions and then put into action those choices

- If extra than 50% of their time is devoted to company operations or administration

Exempt staff beneath the administrative, executive, and expert exemptions — also named the white collar exemptions — are guaranteed a minimum yearly fork out of $35,568, an volume equal to no less than $684 per 7 days. Also, the state of California mandates that exempt workforce be compensated at minimum twice the bare minimum wage dependent on a workweek of 40 hours.

Now, what happens if you misclassify a non-exempt personnel as exempt? The penalties can be high-priced, irrespective of whether the misclassification was produced knowingly or unknowingly:

- Payment of back pay out for unpaid overtime

- Liquidated damages

- Payment of back taxes and their linked fines and pursuits

- Attorney’s fees, if relevant

- Other penalties, these types of as meal or rest split penalties

Check with with your HR counsel to be certain every of your staff is categorised appropriately.

How to pick out amongst salary vs hourly pay back for your enterprise

For numerous individuals, staff compensation is a key thing to consider when task searching. Hourly and salaried positions both have strengths and down sides, the most pressing of which is how they get compensated.

So what factors must you look at when identifying irrespective of whether to pay back your employees an hourly wage vs salary?

Talent profile

Particular capabilities are only wanted on a just one-time or aspect-time basis, and paying out by the hour may be the very best possibility. You may possibly require to utilize consultants and some blue-collar workers quickly, so an hourly wage alternatively of a monthly wage helps make perception.

Significance

Contemplate how essential an employee’s part is to the small business. Will the small business purpose as normal if the function is quickly vacated? If not, a income just could possibly be the incentive your worker is seeking for. A lot of workers equate a salaried place to career safety, furthermore a opportunity to develop their career. A salaried personnel, given that they ordinarily receive extra and much better rewards, is extra very likely to continue to be in a business than their hourly counterpart.

Supply and need

Similar to when rates of commodities skyrocket in response to insufficient supply, wages are topic to the mechanics of source and demand. Gurus and experienced workers can be challenging to find, and some are unable to render 40-hour workweeks.

This is when you draft a proposal that’s agreeable to both of those you and the prospect. To uncover the finest price for a unique task and the baseline for month-to-month or hourly fork out, seem at print and on-line job advertisements or uncover sources at professional associations.

The best payroll application for managing the two salaried and hourly staff members

Now that you have identified the ideal way to spend your workforce, it is time to make sure they get paid appropriate and on time. The proper payroll application process can aid you do just that. But with so many options in the market place, how do you know which one particular most effective suits your wants?

Below are some of the best payroll computer software devices The Ascent has thoroughly reviewed for your consideration:

1. OnPay

OnPay is a complete-service payroll technique created for compact firms. For a single monthly cost, you get functions these as:

- Unrestricted every month spend operates

- Payments and tax filings

- Account set up and facts migration

- Time-monitoring and accounting integrations

- Payments by using debit card, verify, or immediate deposit

- Automatic W-2 and 1099 filings

- 40+ payroll reports

- HR portal

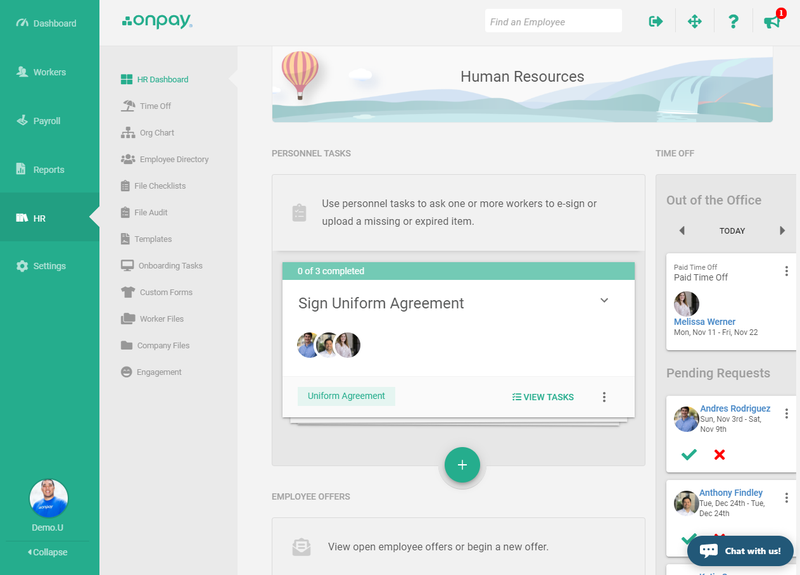

OnPay arrives with a built-in HR suite at no additional cost. Impression supply: Writer

The system also will allow you to spend both equally contractors and workforce. Furthermore, it’s offered in all 50 states. You can use OnPay for cost-free for one thirty day period. Soon after that, you shell out a base rate of $36 for each month, furthermore one more $4 for every thirty day period for every worker or contractor.

2. QuickBooks On the net Payroll

When it will come to accounting application, QuickBooks is a identify which is difficult to beat. Also developed for little organizations, Intuit’s QuickBooks On line Payroll is an inexpensive entire-provider payroll system that incorporates necessary attributes these kinds of as:

- Automatic tax calculations on just about every paycheck

- Automated tax filings, which includes calendar year-close filings

- Endless payroll operates

- Workforce portal the place personnel can perspective compensated time off (PTO) balances and obtain pay back stubs

- Downloadable payroll experiences

- Time-tracking on the go

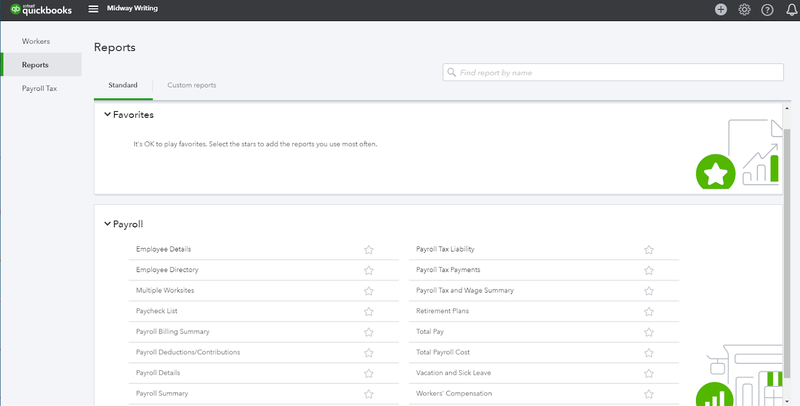

QuickBooks Payroll carries distinctive forms of payroll experiences you can use correct out of the box. Impression resource: Writer

To see if it is the suitable payroll system for you, QuickBooks On the net Payroll gives a absolutely free 30-working day demo. Subscription starts at $22.50 per thirty day period (a 50% price reduction as of this crafting), additionally a different $4 for every staff per month.

3. Patriot Payroll

Patriot Payroll is the payroll resolution suitable for escalating businesses. It provides two payroll offers: Fundamental and Full-Company. Essential is priced at $10 for each month, moreover another $4 for every thirty day period for just about every employee or contractor. Characteristics contain:

- Free setup and guidance

- Customizable deductions and contributions for your wellbeing insurance, 401(k), garnishments, and so on.

- Printable W-2s

- Automatic PTO accruals

- A number of pay back prices

- A number of locations

- Cost-free personnel portal, workers’ comp integration, and direct deposit

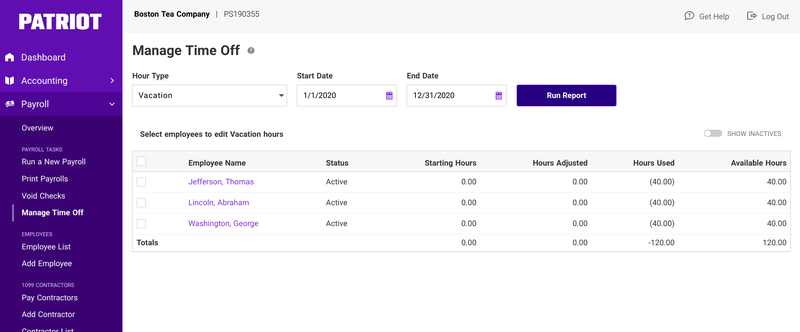

With Patriot, you can automate PTO accruals and add accrued time-off hrs to every employee’s payroll. Image source: Writer

If you need to have payroll taxes submitted and deposited for you, way too, go for the Entire-Service bundle. It is priced at $30 per thirty day period, additionally another $4 for every month per contractor or worker. Equally the Basic and Whole-Service alternatives offer you cost-free 30-working day trials.

Devise a profitable pay back scheme and hold workers delighted

Every enterprise has exclusive wants, and both equally hourly and wage payment solutions have execs and disadvantages. Determine out what makes feeling for your enterprise. Know the applicable wage and hour legislation in your metropolis and state, and check with with a competent skilled when in doubt.

Then, select a excellent payroll program system that allows you decide how salaries are paid (by way of examine or immediate deposit, for case in point), integrates with necessary accounting and HR applications, and presents set up and knowledge migration support need to you talk to for it.

And if you need to master exactly how the worker payroll method works so you know what you are having into, here’s a rapid guideline on how to run payroll by The Ascent’s resident accounting skilled.