ANGHI/iStock by using Getty Photographs

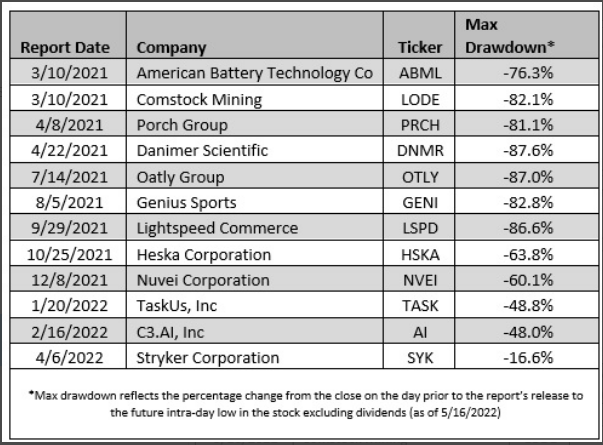

Spruce Point Administration, an activist limited advertising fund launched by previous financial commitment banker Ben Axler in 2009, introduced a short report Tuesday calling for a 40-60% decrease in Alpha Metallurgical Means (AMR). Axler usually takes an “all of the above” approach to the small, citing his firm’s “prescient phone calls” in the commodity sector, and pointing to a laundry listing of accounting pink flags, valuation idiosyncrasies and insider sales. While the shorter pitch is light on forward-looking field fundamentals, any pitch from a short-concentrated fund that survived from 2009 to 2022 really should be regarded meticulously. As evidenced by a listing of Spruce Point’s successes of late:

Metallurgical coal is anticipated to account for 90% of Alpha’s (AMR) shipments in 2022, even though thermal coal volumes are anticipated to account for 10% of income. Place seaborne fulfilled coal costs have a lot more than doubled from their 5-yr typical, when thermal coal costs have risen by ~5x. A wide range of supply / demand things have contributed to the rally, and drawn trader attention of late. The 105 web site presentation from Spruce Stage dedicates ~2 pages to offer / desire and selling price fundamentals.

Spruce Stage showcases the fund’s good results shorting commodity organizations with three case studies, which includes a micro-cap antimony pitch from 2012 (UAMY), a gold mining / EV pivot in 2021 (LODE), and an around-valued oat milk producer in 2021 (OTLY). Although the bull scenario for Alpha (AMR) rests on ahead-seeking coal price tag fundamentals, the bear-case from Spruce Position features a gentle sprinkling of commodity investigation, whilst resting seriously on perceived management miss out on-deeds.

The valuation circumstance, and 40-60% share cost collapse, is derived from putting a 3-4x EBITDA many on Spruce Point’s 2023 EBITDA forecast of $715m. It can be noteworthy that Alpha (AMR) generated $504m of “adjusted” EBITDA in Q1 2022 on your own. And though Spruce Place will make the case that Alpha’s (AMR) 4.3x 2023 EBITDA several appears to be like superior relative to coal friends, it truly is really shut to Warrior’s (HCC) multiple. Given Warrior (HCC) and Alpha (AMR) both of those largely website traffic in the secularly rising metallurgical coal small business, ignoring the decreased thermal coal multiples most likely makes perception.

With little in the way of a differentiated commodity perspective, and somewhat consensus valuation framework in spot, the remainder of the pitch focuses intently on accounting and managerial pink flags. Which is not to say the pitch really should be overlooked. Famed brief-vendor Jim Chanos shorted Enron in 2000 as a result of aggressive accounting techniques – not a differentiated watch on commodity markets or power conglomerate valuation. It truly is really attainable that Alpha (AMR) bulls could be suitable on improving upon coal fundamentals, although Spruce Position could be spot on with its bearish forensic accounting investigation.

The initially accounting argument from Spruce Point focuses on simple output outcomes. The firm’s 2021 10k signifies “created tons bought” and “depletion from manufacturing” had been 15.6-15.9mt on the other hand, figures in the investor presentation lead the market place to think administration delivered 16.3mt of production all through the yr. Though this could be proof of administration miss-deeds, it could also be a result of typical enterprise methods. Alpha (AMR) states in its 10k “we also offer coal manufactured by many others, some of which is processed and/or blended with coal developed from our mines prior to resale, with the remainder acquired for resale.” It is a problem to say no matter whether the ~.6mt big difference in creation is a outcome of bad accounting controls, administration pass up-deeds, or badly edited shows determining “income” as “manufacturing.”

The record of considerations grows from there. Income recognition by state. Inflated inventory and reserves. Charge allocation accounting. Line-item allocations to income move from functions. The enterprise has a troubled and complicated past, and you can find no shortage of accounting issues outlined by Spruce Point. Nevertheless, the investigation does not stage to a “silver bullet” for each se, but somewhat a sequence of questionable tactics that allude to reliability problems. A adjust in auditor does not help the company’s circumstance.

It will be interesting to see how investors move forward from in this article. Limited stories with powerful evidence of fraud, like rolling a truck down a hill (NKLA), sink share selling prices swiftly, leaving investors with unavoidable losses. In this case, Alpha (AMR) is below-executing Warrior (HCC) by ~2% on the day. As the Spruce Point report indicates, each firms trade at related valuations. Traders with a bullish satisfied coal see, but new fears all around Alpha’s (AMR) accounting, could trade into Warrior (HCC), thereby maintaining exposure to the commodity cycle. Buyers self-confident in management and the cycle could maintain, noting a new forced customer has entered the industry. On the other hand, shorts who are not able to say with self confidence that administration has misled investors, might be picking up nickels on the tracks in entrance of an Alpha Achieved (AMR) educate entire of $400/t thermal coal.

More Stories

How Many Business Cards Should You Order?

Quick Guide to Implementing Business Intelligence, Data Warehousing & BPM

How to Start a Foreclosure Cleanup Business “On the Cheap”