Image source: Getty Images

Journal entries are used to record the financial activity of your business. Journal entries are either recorded in subsidiary ledgers if you’re keeping your books manually, or they’re recorded directly into the general ledger (G/L) if you use accounting software.

Whichever way they’re recorded, they are a necessity for any business.

Overview: What is a journal entry?

As a small business owner, one of the jobs you typically assume is that of a bookkeeper or accountant. Part of that job is recording journal entries.

If you’re familiar with accounting terms, you know that journal entries are simply a record of all of your business transactions. They are the first step in the accounting cycle, and perhaps the most important, as they represent all of the financial activities that will affect your business.

It’s important to know how to create a proper journal entry, or general entry for your business. Accounting journal entries always follow the double-entry accounting method, with each journal entry always having a debit entry and a credit entry.

Journal entries are always dated and should include a description of the transaction. Accountants and bookkeepers typically assign a unique number to each journal entry when they’re entered manually, and if using accounting software, your application will automatically assign a number to each journal entry.

How to prepare journal entries for your small business

The first step in preparing journal entries for your business is to determine exactly what transaction needs to be entered.

If you’re using accounting software, the majority of journal entries are made by your accounting software, so you’ll only need to enter month-end adjusting entries, such as when reconciling your bank accounts, or when entering accruals for payroll and other expenses.

Let’s use the following as an example. You visit your local office supply store and purchase paper and pens for your business. The total purchase is $150.00. Here’s how you would prepare your journal entry.

Step 1: Identify the accounts that will be affected

Before you can write and post a journal entry, you’ll need to determine which accounts in your general ledger will be affected by your journal entry. In this example, your office supplies account and your cash account are the accounts that will be affected.

Tips for identifying the right accounts:

- Sort your transactions first: If you have bank deposits, expenses, and sales entries to make, sorting them by transaction type will make it much easier to record your journal entries.

- Use common sense when identifying the correct accounts: This process may be confusing at first, but as you process more journal entries, you’ll begin to understand which accounts you should use for your transactions.

Step 2: Determine your account type

If you spent $150 at the store, you’ll be creating an expense for your office supplies account while reducing the amount of cash in your bank account. You’ll need to apply standard accounting rules to each account.

To increase an expense account, you would need to debit the account, and to decrease your cash account, which is an asset, you would need to credit the account.

Tips for identifying the account type:

- Remember your account types: Account types include Assets, Liabilities, Expense, Revenue, and Capital/Owner Equity accounts. All journal entries in accounting have to fall into one of these categories. For instance, the office supplies account is an expense, while the cash account is an asset.

- Use standard accounting rules to determine which account is debited and which account is credited: When recording the above transaction in the office supplies example, you will be increasing your expenses because you purchased office supplies, which is an expense account, while decreasing your assets because you used your cash account, which is an asset, to purchase those supplies.

|

Account Type |

Increases Balance |

Decreases Balance |

|---|---|---|

|

Assets: things of value such as cash, accounts receivable, bank accounts, computers, and furniture |

Debit |

Credit |

|

Liabilities: things you owe including accounts payable and loans |

Credit |

Debit |

|

Revenue: monies received for products or services during the course of doing business |

Credit |

Debit |

|

Expenses: the cost of doing business including supplies, rent, payroll expenses, etc. |

Debit |

Credit |

|

Capital / Owner Equity: represents your ownership or financial interest in the business |

Credit |

Debit |

Step 3: Prepare your journal entry

You’ve identified the accounts that will be involved in your journal entry, as well as the type of accounts they are. Now you’re ready to prepare your journal entry.

Tips for preparing a journal entry:

- Enter the correct date: The first step is to date your journal entry. This is to ensure it’s posted in the correct period.

- Write out the account name and number: When preparing a journal entry, always include the G/L account number as well as the account name.

- Enter the debit and credit amount: Using the above example, you will be debiting (increasing) your office supplies account, which is an expense account, and crediting (reducing) your cash account, which is an asset account.

Example of a journal entry

Below is an example journal entry that was completed based on the above financial transaction.

|

Date |

# |

Account |

Debit |

Credit |

|---|---|---|---|---|

|

1-15-2020 |

1 |

Office Supplies (5001) |

$150 |

|

|

1-15-2020 |

1 |

Cash (1001)(Office supplies purchased for business) |

$150 |

Notice that the date is entered for both lines. It’s journal entry No. 1, the account number is included after the account name, and the office supplies account has been debited and the cash account credited.

The best accounting software for documenting journal entries

By far, the best way to reduce the amount of journal entries you need to do while easily completing the ones necessary is by using accounting software.

When you’re using accounting software, journal entries are completed every time you process accounts payable, calculate accounting cost, or perform any other basic bookkeeping transactions, leaving you to record only items such as month-end adjusting entries.

Accounting software also automatically calculates and posts closing entries, ensuring that opening balances are correct for the new year.

Here are three small business accounting applications that make creating and posting journal entries a breeze.

1. AccountEdge Pro

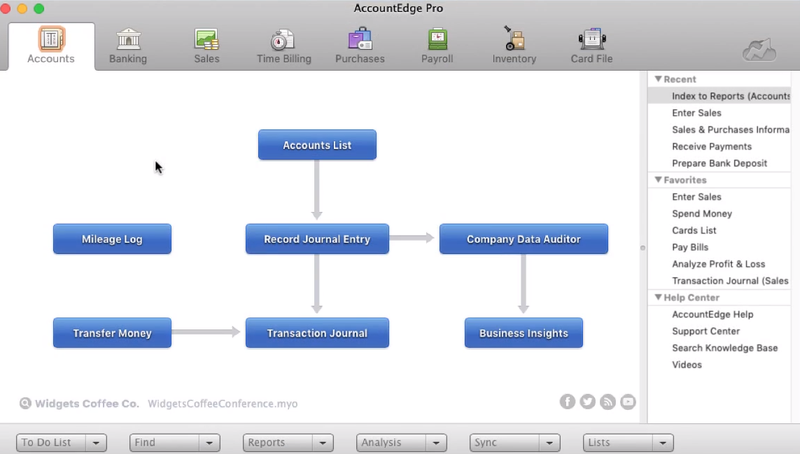

AccountEdge Pro is a desktop application that also offers remote connectivity. AccountEdge Pro is a good fit for small and growing businesses that are looking for an accounting application that can grow along with them.

Particularly well-suited for retailers and online sellers, AccountEdge Pro offers integration with Shopify and UPS Shipping.

Under the Accounts tab, AccountEdge Pro gives you the option to record a journal entry. Image source: Author

AccountEdge Pro does not include a bank feed, but you can download your bank statement for reconciliation within the application. The Accounts entry screen in AccountEdge Pro makes it easy for you to record journal entries, with an option available to make a journal entry recurring, as well as the ability to reverse a previous month’s journal entry for things such as accruals.

A memo field is also available for you to enter a description of the journal entry.

AccountEdge offers four plans: Basic, Pro, Priority Zoom, and Priority ERP, with pricing starting at $149 annually.

2. Sage 50cloud Accounting

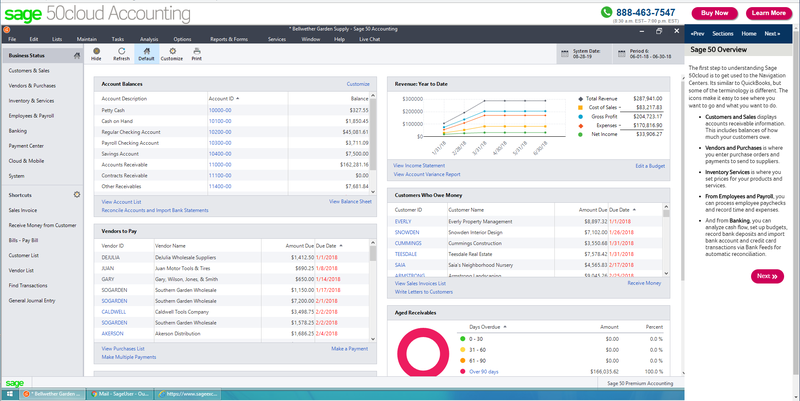

Sage 50cloud Accounting is considered a hybrid application, offering on-premise installation as well as remote access to the application using Microsoft 365.

Sage 50cloud Accounting offers plans suitable for one-person offices as well as businesses that require multi-user capability, with the Quantum edition supporting up to 40 users.

The Sage 50cloud Accounting dashboard offers a summary view of account balances. Image source: Author

You can easily create journal entries in Sage 50cloud Accounting by going to the General Journal Entry screen, where you can enter the details of your transaction, including a unique transaction code and description of the journal entry.

You can also reverse a transaction by clicking on the Reverse Journal Entry box at the top of the screen.

Sage 50cloud Accounting offers three plans: Accounting, Premium Accounting, and Quantum Accounting, with pricing starting at $278.95 annually.

3. QuickBooks Online

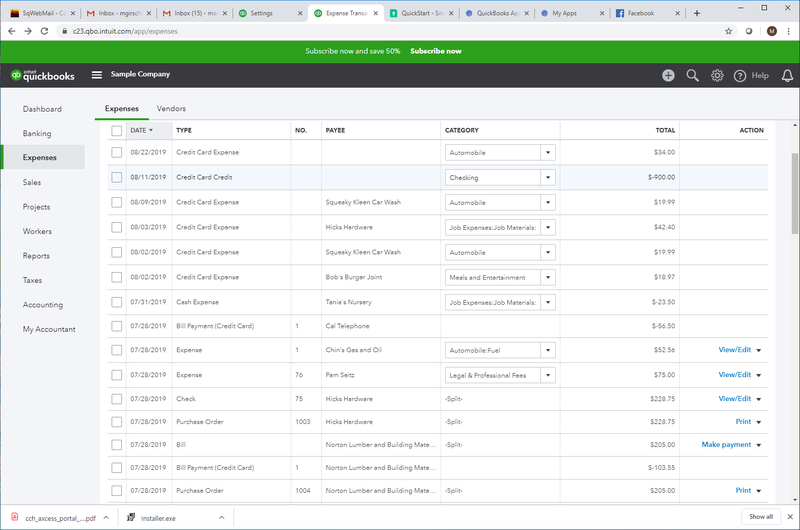

Originally designed for very small businesses, QuickBooks Online continues to add features and functionality, making it a good fit for growing businesses as well.

Available in four plans, with a self-employed plan also available, features are very plan-driven, with many features found only in the more expensive plans.

The banking feature in QuickBooks Online lets you easily record your expenses. Image source: Author

QuickBooks Online offers features such as automatic bank feeds, which will greatly reduce the number of journal entries that need to be created.

When you do need to create a journal entry, you can do so easily, with QuickBooks Online automatically assigning a reference number to all journal entries. A description field and a memo field are available to detail what the entry is for.

QuickBooks Online also lets you delete a previously posted journal entry, but in order to maintain an audit trail, any journal entry posted in error should be reversed, not deleted.

QuickBooks Online offers four regular plans: Simple Start, Essentials, Plus, and Advanced, as well as a Self-Employed plan available for freelancers, with pricing starting at $10 per month for the first three months.

Journal entries are part of the financial accounting process

If you’ve made the choice to use accounting software, financial accounting journal entries become rare, with typical journal entries made only to enter accruals, month-end adjustments, and depreciation expenses.

In turn, your accounting software application handles the brunt of the work, creating journal entries automatically when financial transactions are processed, increasing accuracy and reducing your workload.

If you’d like to learn more about other small business accounting applications, be sure to check out our small business accounting software reviews.