Antonio Bordunovi/iStock Editorial via Getty Images

Investment thesis

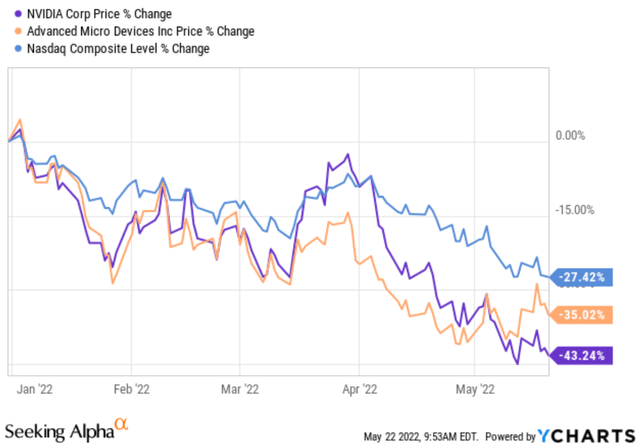

Potential Nvidia (NASDAQ:NVDA) investors are on edge as it will report its Q1 Fiscal Year 2023 results on May 25 amid extreme market volatility. The Nasdaq index has lost more than 27% YTD due to international geopolitical risks and the heightened expectation of a recession in the U.S., Europe, and China.

The large market corrections have brought down many high-quality stocks to a more reasonable valuation such as NVDA and AMD (AMD). NVDA prices have dropped more than 43% YTD (and AMD more than 35%). Its valuation has contracted even more given the earnings growth. As such, many potential investors are tempted to bottom-fish for this high-growth stock.

However, our view is that you should not pull the trigger just yet. We still see mixed signals ahead. On the one hand, NVDA’s valuation is now about 37x PE on a non-GAAP TTM basis, a far cry from its 100+ PE in the recent past. Its true economic or owners’ earnings are even lower, around 32x, as you will see later. Looking ahead, there are growth catalysts to further drive down valuation. It’s rolling out a host of new offerings to tap into the high-margin and high-growth market. These products include the GeForce RTX 3050 desktop GPU, GeForce RTX 3080, Nvidia AI Enterprise 1.1 software, and also the recent launch of its Nvidia Omniverse to millions of creators.

However, on the negative side, such valuation is still at an elevated level. And there are several major fundamental risks unfolding ahead. Chip shortages can persist and even worsen. The recent collapse of the cryptocurrency price could negatively impact the demand for its mining chips. In terms of macroeconomics, as the Fed raises rates to combat inflation, the dollar is becoming more attractive, which could dampen exports and raise the odds of a technical recession. Several high-profile firms such as Meta (FB), Netflix (NFLX), and Peloton (PTON) have announced hiring freezes or even layoffs recently either due to over-expansion or weaker than expected demand growth. Such negative developments are very likely to happen to or impact NVDA also in the near future.

And we will elaborate on these issues immediately below.

Seeking Alpha and YCharts

NVDA’s accounting EPS and owners’ earnings

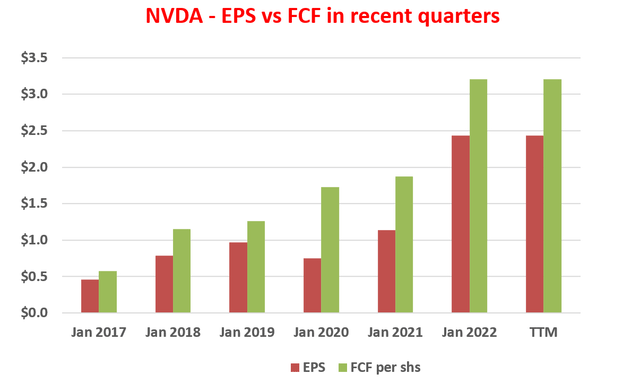

We first start with positives: Its more reasonable valuation and strong product portfolio. The commonly quoted PE for NVDA is about 37x on a non-GAAP TTM basis and about 43x on a GAAP TTM basis. It’s admittedly still not cheap, but it’s much more reasonable considering A) a comparison against its peak PE above 100 not that long ago, and B) the commonly quoted accounting earnings do not accurately reflect its true economic earning power. As a high-growth stock that invests aggressively in growth capex, the accounting earnings distort its true earning power substantially.

Simply comparing its free cash flow (“FCF”) and accounting EPS already reveals the disparity. Over the years, as you can see, FCF has regularly surpassed EPS. The FCF/EPS conversion ratio is consistently above 1 and has been on average about 145%.

The next section will show that the FCF understates its owners’ earnings too because of its high growth capex spending.

Author based on Seeking Alpha data

NVDA: High growth CAPEX investment

The key to understanding the OE (owners’ earnings) is to distinguish between growth and maintenance CAPEX. Growth CAPEX is optional and should not be considered a cost. For decades, investors like Warren Buffett have promoted this concept. The following quote from Buffett best describes it (I added the emphasis):

These represent (“a”) reported earnings plus (“b”) depreciation, depletion, amortization, and certain other non-cash charges…less (“c”) the average annual amount of capitalized expenditures for plant and equipment, etc., that the business requires to fully maintain its long-term competitive position and its unit volume…Our owner-earnings equation does not yield the deceptively precise figures provided by GAAP, since (“c”) must be a guess – and one sometimes very difficult to make. Despite this problem, we consider the owner earnings figure, not the GAAP figure, to be the relevant item for valuation purposes…All of this points up the absurdity of the ‘cash flow’ numbers that are often set forth in Wall Street reports. These numbers routinely include (“a”) plus (“b”) – but do not subtract (“c”).

However, estimating (“c”) is indeed difficult and involves a more advanced understanding and analysis of the financial statements. The basic concepts and steps are detailed in my earlier article on AAPL. And in this article, I analyzed (“c”) for NVDA using Bruce Greenwald’s method (detailed in my earlier article or Greenwald’s book entitled Value Investing).

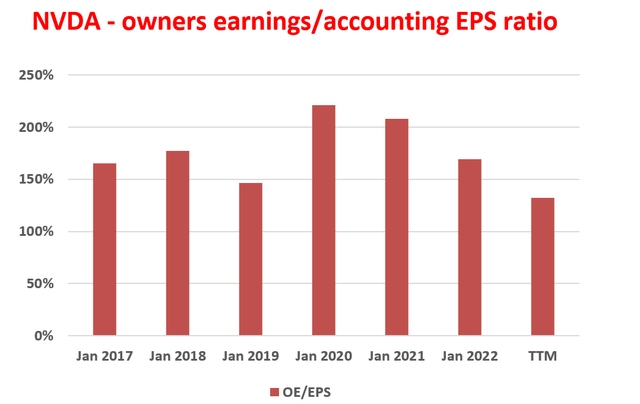

Under this background, the following chart shows NVDA’s true economic earnings compared to its accounting EPS. The results are shown as a ratio between the OE and EPS. And the ratio has been on average 174%. That is, its true economic earnings are 1.74x time of its accounting EPS because most of its capex expenditures are used to fuel growth and hence are optional and should not be considered a cost. Its current OE to EPS ratio is 132%. So correcting for the growth CAPEX, its PE based on owners’ earnings is “only” about 32x, even lower than the accounting PEs quoted before.

Author based on Seeking Alpha data.

Valuation is more reasonable but still elevated

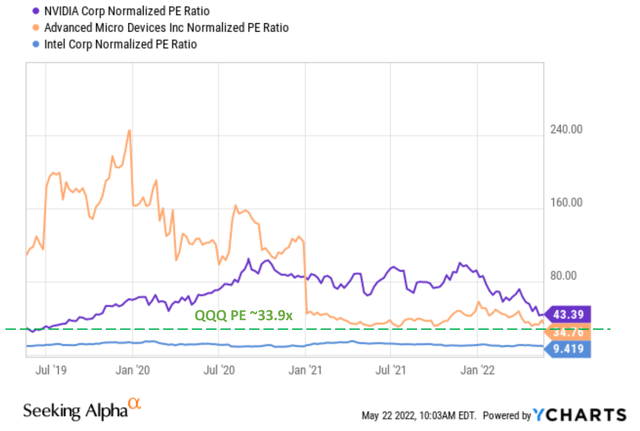

The recent correction has brought NVDA’s valuation to a more reasonable range both relative to its historical valuation and also the valuations of the overall market. As aforementioned, in accounting terms, NVDA is currently valued around 37x to 43x PE, a valuation haircut of more than a half from its peak level of 100+ PE.

But such a valuation is still expensive in absolute terms and also relative terms, even after the disparity between accounting profits and true profits is adjusted. As you can see, it’s still relatively expensive when compared to Nasdaq 100 index, with a current PE of about 34x (and is at a historically elevated level itself). Compared to its peers such as AMD (trading at 35x accounting PE) and Intel (INTC) (about 10x accounting PE), it’s also still at a significant premium.

Author and Seeking Alpha data.

And growth is truly cheap

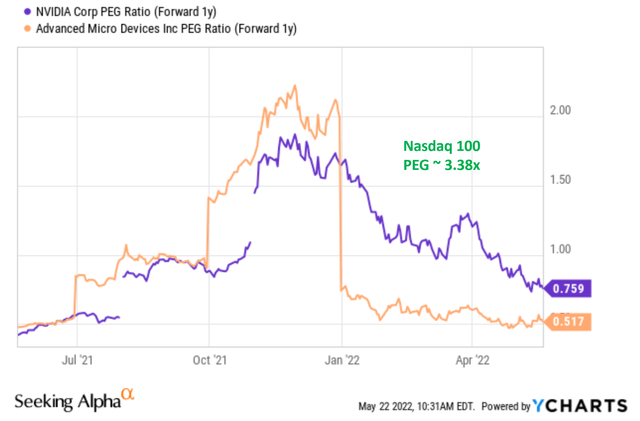

The main attraction is growth. Its current valuation is indeed at a considerable discount when adjusted for growth. The current PEG ratio for NVDA is only roughly 0.76x, as shown in the figure below according to Seeking Alpha data. It’s still about 25% higher than AMD admittedly, but it’s only a fraction of the Nasdaq index, whose PEG is estimated to be about 3.4x. In this estimate, I assumed a 10% annual growth rate for the Nasdaq 100 index. And NVDA’s growth is priced at about 1/4 to 1/5 of the Nasdaq index.

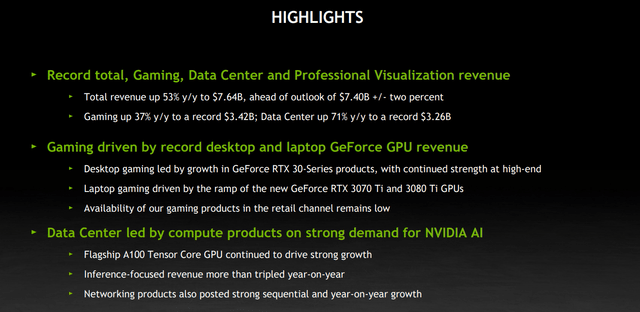

Looking ahead, there are more growth catalysts for NVDA. The company is rolling out a host of new offerings, like the GeForce RTX 3050 desktop GPU, GeForce RTX 3080, and 3070 laptop GPUs in the gaming space. As it continues to strengthen in the high-end gaming market, it’s likely to further expand its margin and fuel growth. Its data center is another segment with high-growth potential. The Data Center unit just released the Nvidia AI Enterprise 1.1 software. Given such a shift in product mix to higher-margin offerings, a gross margin in the range of 65% GAAP to 67% non-GAAP is expected.

However, we also see some substantial uncertainty ahead as detailed below.

Seeking Alpha and YCharts NVDA earnings report

Other risks and final thoughts

Besides the high PE mentioned above, we also see a few other major risks ahead as listed below. With a balanced consideration of the positive and negative, our final verdict is a neutral rating. Potential investors should not pull the trigger just yet.

Macroeconomic risks. As high inflation and supply chain interruptions persist and even heighten, the probability of a recession has increased substantially in the past few quarters. NVDA’s high-end and high-margin products are particularly sensitive to such economic downturns. Such concerns have led several high-growth tech firms such as Meta, Netflix, and Peloton to announce hiring freezes and even layoffs in recent weeks. Such hiring freeze and layoffs could create second-order effects and dampen the demand for NVDA’s products.

Risks with cryptocurrency mining. NVDA’s products have considerable exposure to the cryptocurrency mining business. The crypto market has been extremely volatile and had just suffered a large loss in recent days, which could impact demand for NVDA’s products ahead. As EVP and CFO Colette Kress commented,

Our GPUs are capable of cryptocurrency mining, so we have limited visibility into how much of this impacts our overall GPU demand. Nearly all desktop Nvidia Ampere architecture GeForce GPU shipments are light cache rate to help direct GeForce supply to gamers. Cryptomining processor revenue was $24 million, which is included in OEM and others.

More Stories

Three Keys of Branding That Will Turn Small Business Advertising Expense into an Investment

Perbedaan Logo Design Dengan Branding

Travel Agents Can Help With Vacations and Business Travel