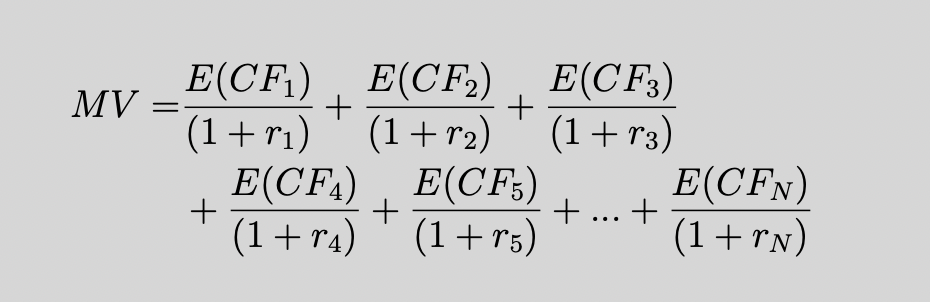

The target of discounted hard cash movement (DCF) valuation examination is to answer the dilemma, “What is this asset truly worth?” as in, what is the price that a rational particular person would be inclined to pay back for this asset in a aggressive asset current market. It is a issue to which very good responses are often desired. The DCF valuation product is a hypothesis about the solution: market place benefit (MV) equals the sum of the discounted expected future hard cash flows that the asset will provide to its owner:

where by E(CFi) is the expected cash movement at foreseeable future time i, ri is the discount price for funds flows to be received from this asset at potential time i, and N is the amount of dates where money stream is anticipated to be been given. The money flow anticipations and price reduction prices are all those of the equilibrium asset purchaser who competes with other potential consumers facing—at the very least when the asset is fungible and has a fantastic substitute owned by others—numerous potential sellers.

Economist Irving Fisher is credited with initially suggesting in his 1907 ebook, The Rate of Fascination, that any asset’s benefit is equal to the existing benefit of its upcoming money. Three a long time afterwards, J.B. Williams took a additional step in his 1938 book, The Idea of Expense Benefit, asserting that the accurate price of a popular inventory could be calculated as the existing value of its future dividends. In the early 1950s, Joel Dean proposed that funds tasks could be evaluated by projecting long term cash flows, discounting them to current value, and comparing present worth to expense price. It may perhaps have been Dean who initial referred to this strategy by the expression “discounted hard cash stream.” As economic economists got far more specific about the principle of asset pricing, the concept of DCF valuation grew to encompass the assertion that market place values were decided by discounted anticipated hard cash flows. Along with theoretical and empirical endeavours to exhibit that economic styles could be employed to estimate low cost premiums in the 1960s and 1970s, DCF valuation was, by the 1980s, in use for asset valuation and cash budgeting in the course of the planet by company financial analysts, stock analysts, financial commitment bankers, and consultants.

DCF valuation “works” in a person undeniable sense: a method of the form

can “explain” any asset rate. Equation (1) is a one equation expressing industry benefit as a operate of a huge (possibly-infinite) variety of variables. Since the appropriate-hand facet variables are unobservable predicted values and price cut rates, any regarded sector value has a perhaps-infinite range of DCF explanations. If, as is typically the situation, the left-hand side market benefit is unidentified and is calculated from the suitable-hand aspect of equation (1), then there are a potentially-infinite number of possible industry values for any provided asset, just about every with a probably-infinite amount of ideal-hand aspect selections of expected money flows and price cut costs.

But clarification is not prediction. What consumers of DCF valuation are practically often intrigued in is an exact prediction of the market place value of an asset. The DCF hypothesis is not the trivial a person that a one equation in possibly-infinite amount of unknowns can crank out any market place benefit wanted. Of course, it can. Customers of the DCF valuation methodology—and individuals of its results—rely on the methodology’s means to predict the value at which an asset would trade arms beneath some assumed market place ailments. DCF valuation methodology, as introduced in valuation texts and finance lessons, claims that if an asset with these expected funds flows and low cost prices was made available in an asset industry, then it would offer for these types of-and-this kind of an sum.

The DCF Emperor Has No Outfits

Regardless of the ubiquitous use of the DCF valuation technique, even so, there is no proof that it works for predicting the industry worth of money initiatives, organizations, and widespread stocks. Aside from the lack of ability to notice the inputs to the DCF calculation—expected income flows and low cost rates—we do not even have superior causes to feel that those portions exist in any serious sense.

It might come as a shock to all those who learned these techniques in enterprise college or are informed by these kinds of folks that DCF is a trusted resource that not a single of its assumptions has great proof guiding it. There is no compelling proof that authentic buyers decide what to pay out for belongings whose upcoming money flows are not specified by contract (as with bonds or annuities) by discounting their “expected’” long term money flows in a linear trend, no powerful proof that buyers variety anticipations of a series of future funds flows in the way theory assumes, and no compelling evidence that price reduction prices of the sort assumed in concept exist in any actual sense, a great deal fewer that we know how these imagined special discounts would be determined. In fact, there is powerful evidence against each and every just one of the three explanations necessary to the reliability of DCF.

What About Bonds?

When I inquire fellow fiscal economists what proof they would place to if asked no matter if DCF performs, they come up with only 1 remedy: bonds. Bonds do lend on their own to a DCF interpretation, of class, but only since they have contractually-specified dollars flows that can be matched to an observed cost. Default-totally free bonds with noticed costs can hence be interpreted as satisfying the DCF valuation methodology, but only simply because the appropriate equation is then a single in a one unfamiliar, the yield-to-maturity which, for default-free of charge funds flows, equals the anticipated return above the lifetime of the bond. But the bond analogy breaks down swiftly when bonds bear default-hazard, given that bond interest and principal reimbursement then grow to be unsure and the yield-to-maturity is no for a longer period equal to an envisioned return.

Assignments, Firms, and Stocks Are Not Bonds

Contrary to bonds, capital assignments, corporations, and frequent shares do not guarantee set funds flows and usually have unsure longevity. We can generally healthy a given sector value—say, for the inventory current market capitalization of community corporation—to a discounted dollars movement expression, but that expression will be just one of an infinite set of attainable combinations of anticipated cash flows and discounted rates. Competing models can not be distinguished right after-the-truth due to the fact there will be an infinite range of realized hard cash flow paths and time-different price cut premiums that are reliable with any given predicted money move and price cut charge assumption at the time of modeling. The untestable character of the DCF valuation technique points out why there is pretty much no work even purporting to examination the technique. Just one exception, Kaplan and Ruback, The Valuation of Dollars Circulation Forecasts: An Empirical Examination, Journal of Finance, 50(4), 1059-1093 (1995), illustrates the dilemma properly, “testing” DCF by fitting acknowledged offer charges in hugely-leveraged transactions to disclosed cash flow forecasts. But that is akin to the default-free of charge bond, in particular offered the incentive to match deal selling prices to hard cash movement forecasts.

DCF Angels on DCF Pins

The untestable mother nature of the DCF valuation methodology clarifies two intriguing facts about the use of DCF in practice. Initially is the close to-obsession in valuation texts with arcane methodologies for funds movement estimation and low cost charge calculations. Lacking empirical effects as to which hard cash-move forecasting methodologies and lower price rate estimations guide to the most effective predictions—impossible simply because DCF is untestable in its common applications—financial analysts and appraisers as a substitute discussion endlessly about good approaches to transform accounting quantities to cash stream estimates, proper ways to work out terminal values, and right ways to estimate discount charges. For the reason that DCF is untestable, these debates are basically contests of persuasion.

Second is that DCF’s vast acceptance is justified in a duplicative fashion by attractiveness to its general acceptance. For illustration, the DCF methodology is applied greatly in enterprise litigation. While courts usually have to have scientific and technical proof to be centered on methodologies that are testable and have known precision and precision, courts justify the use of DCF valuation on the basis of its standard acceptance with out inquiry into its scientific validity. Described situations involving DCF valuation typically include the sort of battles of industry experts explained previously mentioned and are commonly resolved by small much more than which specialist persuades the judge, or by a judge that considers himself pro plenty of to make your mind up on his possess the methodological difficulty at hand.

Consequences of Untestability

The untestable mother nature of DCF brings together with its extensive use to produce two most likely troubling (and connected) implications for organization selections.

First, the essence of the DCF valuation is large discounting of long-expression income flows. Discounting of long run money flows so closely usually means that numerous long-term investments will seem terrible relative to the charge of investment decision and initiatives that pay back off quite promptly, that is, in the small-term. This may bias company financial investment versus some lengthy-term investments in the corporate C-Suite and boardroom and amid stock analysts. Opposite to the laments of several commentators, there is no motive to feel that the inventory sector discount rates prolonged-time period investments much too heavily relative to shorter-expression investments. Without a doubt, we know from actual-environment information that buyers seem to be pretty keen to give very small-cost money to corporations in return for the gains that occur when a couple of these corporations does terribly perfectly. But business selection makers who use DCF will usually reject great extensive-time period company jobs just mainly because they assume the validity of the DCF idea and use its methods to select corporate investments.

2nd, the DCF valuation methodology encourages the belief that company administrators and economical analysts can make exact predictions about dollars flows quite a few yrs into the long run. There is no cause to believe that is true, and a lot reason to believe it is not. Even worse, people have a tendency not to make impartial forecasts that are equally probably to be improper in both route, neither biased upward nor downward on normal. Rather, evidence from investigation in psychology exhibits that men and women are excessively optimistic, believing that bad outcomes are significantly less most likely than they are. The mixture of large discounting and optimistic funds move forecasting mix in a noxious way. Business assignments most possible to search superior in a DCF examination are people that are the very least probable to see their forecasts appear to fruition, considering the fact that the best-on the lookout assignments will be these with overly-optimistic hard cash move forecasts. This can make the DCF valuation methodology a recipe for corporate disappointment. Cost-searching for expenditure bankers can make deliberately-overly-optimistic income stream forecasts to offer mergers and acquisitions that destroy company price at the obtaining firm, transferring that price to target shareholders. It is value contemplating regardless of whether an untestable valuation methodology helps reveal the sturdy empirical consequence in company finance that mergers and acquisitions profit only target shareholders and not obtaining companies.

Summary

Assuming that users of the DCF valuation method want prediction and not just rationalization, we need to have to know not regardless of whether we can healthy the DCF equation to an asset rate (we always can) but no matter if there is a way to utilize the methodology to reliably estimate—with some measurable price of error—the market value that an asset would have below assumed sector ailments. Devoid of an response, we have no foundation for self esteem that DCF valuations are anything much more than quantitative narratives, “stories” about asset charges somewhat than scientific estimates. Typical acceptance is not sufficient. The very same was true for thousands of decades about astrology, a discipline most now look at unscientific due to the fact, as 1 author puts it, astrology “is not falsifiable: astrologers cannot make predictions which if unfulfilled would lead them to give up their principle.” Just one must wonder if the similar is now correct of all those who utilize the DCF valuation methodology.

The full paper is obtainable for download in this article.