Image source: Getty Images

A classified balance sheet can be an important resource for your business: breaking down assets, liabilities, and equity into distinct categories. Learn how to make one with our guide.

A balance sheet is a financial statement that displays the total assets, liabilities, and equity of your business at a particular time.

Smaller businesses typically use an unclassified balance sheet, but if you’re looking for a report that provides the same data in a more detailed format, you’ll want to prepare a classified balance sheet.

Most accounting software applications allow you to choose what type of balance sheet you wish to produce, though if you have multiple assets or liabilities you need to properly track, you may want to skip the unclassified balance sheet altogether.

Overview: What is a classified balance sheet?

A classified balance sheet displays the same asset, liability, and equity totals as its unclassified counterpart, but does so with greater detail, classifying them into various categories rather than simply listing them in the standard balance sheet format.

The classifications used will vary depending on the type of business you own, and there is no one way to format a classified balance sheet properly. The chart below lists common balance sheet classifications and examples of the balance sheet accounts that are included in each classification.

|

Balance Sheet Classifications |

Examples |

|---|---|

|

Current assets |

Cash, accounts receivable, inventory, short-term investments |

|

Long-term assets |

Outside investments |

|

Fixed assets |

Land, equipment, furniture and fixtures, accumulated depreciation |

|

Intangible assets |

Goodwill, trademarks, copyrights, accumulated amortization |

|

Current liabilities |

Accounts payable, tax liabilities, current portion of loans payable, accrued expenses |

|

Long-term liabilities |

Loans payable (part due more than one year from current date), tax liabilities, mortgage payable, bank loans |

|

Shareholder equity |

Owner’s capital, retained earnings, additional contributions paid |

Like your unclassified balance sheet, the totals of these classifications must follow the accounting equation, detailed below.

Classified balance sheet vs. balance sheet: What’s the difference?

Both an unclassified and a classified balance sheet include asset, liability, and equity balances, but an unclassified balance sheet does not classify amounts; it simply lists them under their respective categories. These simple balance sheets are frequently used by smaller businesses or internally for information purposes only.

ABC Pet Supplies

Unclassified Balance Sheet

12/31/2019

|

Assets |

|

|

Cash |

60,000 |

|

Accounts receivable |

23,500 |

|

Equipment & fixtures |

17,200 |

|

Total Assets |

100,700 |

|

Liabilities |

|

|

Accounts payable |

4,100 |

|

Mortgage payment |

55,000 |

|

Other liabilities |

1,700 |

|

Total Liabilities |

60,800 |

|

Equity |

|

|

Owner’s equity |

31,000 |

|

Retained earnings |

8,900 |

|

Total Equity |

39,900 |

|

Total Liabilities and Equity |

100,700 |

The unclassified balance sheet lists assets, liabilities, and equity in their respective categories.

While some of the differences between unclassified and classified balance sheets are in the formatting, classified balance sheets are designed to display details.

For example, in the balance sheet above, equipment and fixtures are listed together under assets in the amount of $17,200. On the classified balance sheet below, equipment and furniture are listed separately under a fixed asset category instead of just being listed as assets.

This classification is particularly important to investors and creditors outside of the business who generally look to a classified balance sheet in order to make informed decisions regarding investing or loan approvals.

ABC Pet Supplies

Classified Balance Sheet

12/31/2019

|

Assets |

|

|

Current assets |

|

|

Cash |

60,000 |

|

Accounts receivable |

23,500 |

|

Total current assets |

83,500 |

|

Fixed assets |

|

|

Equipment |

11,200 |

|

Furniture |

6,000 |

|

Total fixed assets |

17,200 |

|

Total Assets |

100,700 |

|

Liabilities & Equity |

|

|

Current liabilities |

|

|

Accounts payable |

4,100 |

|

Other liabilities |

1,700 |

|

Total current liabilities |

5,800 |

|

Long-term liabilities |

|

|

Mortgage payable |

55,000 |

|

Total long-term liabilities |

55,000 |

|

Total Liabilities |

60,800 |

|

Shareholders’ Equity |

|

|

Capital |

31,000 |

|

Retained Earnings |

8,900 |

|

Total Equity |

39,900 |

|

Total Liabilities and Shareholders’ Equity |

100,700 |

The classified balance sheet uses sub-categories or classifications to further break down asset, liability, and equity categories.

Looking at the classified balance sheet example, you’ll see the same asset and liability totals that are displayed on the unclassified balance sheet, with the difference being that the assets and liabilities are further divided into a specific type of asset or liability.

What is the accounting equation?

As a bookkeeper or accountant, one of the first things you learned is the accounting equation, which is:

Assets = Liabilities + Equity

Both a classified and an unclassified balance sheet must adhere to this formula, no matter how simple or complex the balance sheet is.

How to use the accounting equation with a classified balance sheet

Using the accounting equation with a classified balance sheet is a straightforward process. First, you have to identify and enter your assets properly, assigning them to the correct categories.

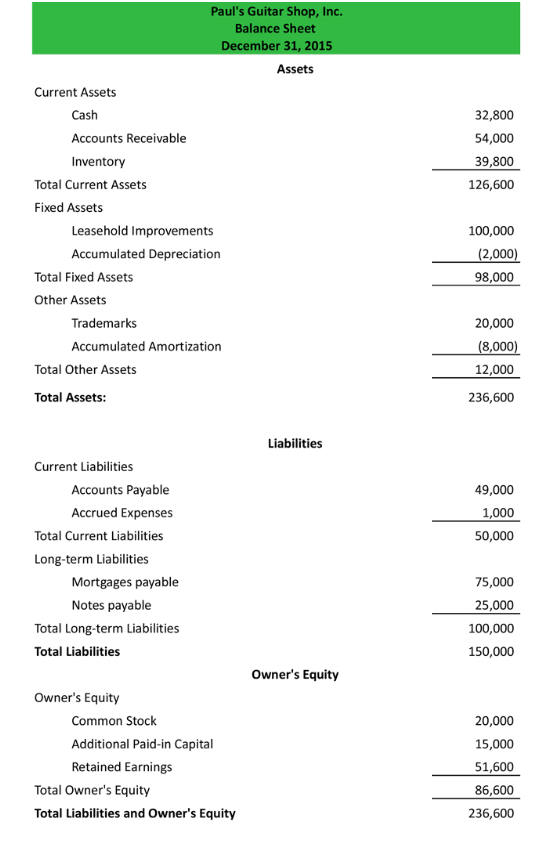

Looking at the classified balance sheet below, you’ll notice that the list of current assets for Paul’s Guitar Shop have been classified into three distinct categories: Total Current Assets, Total Fixed Assets, and Total Other Assets.

The Current Assets list includes all assets that have an expiration date of less than one year. The Fixed Assets category lists items such as land or a building, while assets that don’t fit into typical categories are placed in the Other Assets category.

The same principle holds for the Liabilities section, where you’ll list all current liabilities, as well as those that are long term, such as mortgages and other loans.

Once the information has been entered into the correct categories, you’ll add each category or classification individually. When that is complete, you’ll need to add all the subtotals to arrive at your asset total, which is $236,600.

A sample of a classified balance sheet. Image source: Author

With assets complete, you’ll move on to your liabilities. Balance sheet liabilities, like assets have been categorized into Current Liabilities and Long-Term Liabilities. Once your balances have been added to the correct categories, you’ll add the subtotals to arrive at your total liabilities, which are $150,000.

The final section in your balance sheet, Owner’s Equity, is where you’ll place any stock values, retained earnings as well as any additional capital that you or any of your shareholders may have contributed to the business. Your owner’s equity is $86,600.

Have we followed the accounting equation properly? Let’s add up the totals following the accounting equation formula:

Assets = Liabilities + Owner’s Equity

So, the calculation with our numbers looks like:

$236,000 (assets) = $150,000 (liabilities) + $86,600 (owner’s equity)

Our balance sheet does follow the accounting equation, and it is in balance.

Classified balance sheets are a useful resource for your business

Designed to show what a business owns, what it owes, and what has been invested in the company, the balance sheet, like the income statement and statement of cash flow, is one of the three main financial statements.

The classified balance sheet takes it one step further by classifying your three main components into smaller categories or classifications to provide additional financial information about your business. Once used primarily by larger companies, small business owners can also benefit from running a classified balance sheet.

More Stories

Three Keys of Branding That Will Turn Small Business Advertising Expense into an Investment

Perbedaan Logo Design Dengan Branding

Travel Agents Can Help With Vacations and Business Travel